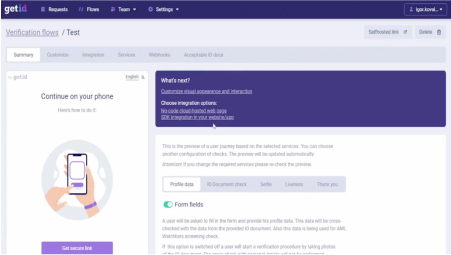

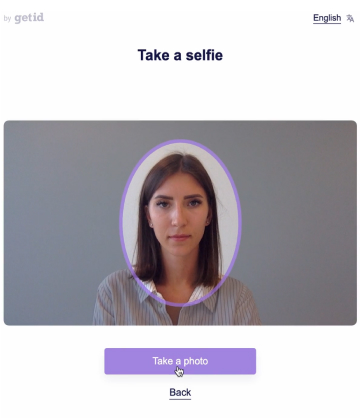

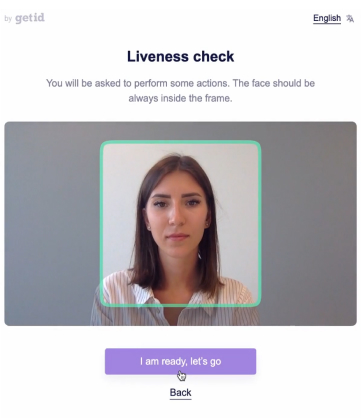

If you’ve enabled the Face Matching Service, the system will ask the customer to take a selfie, which will then be compared to the portrait of the customer in the identity document.

System will not accept bad selfies with bad quality or multiple faces.

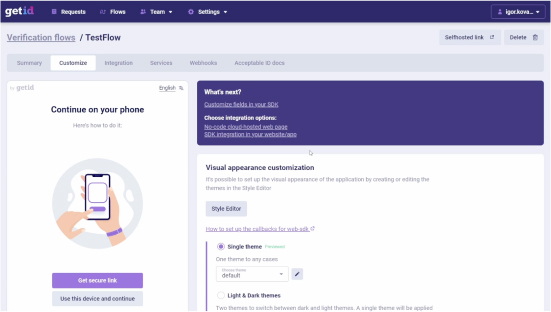

By default, for desktop users system will ask to switch to mobile phone via QR-code for better quality of taken pictures. You can force user to switch to mobile or leave an option to proceed on a desktop.

If your customer fills in the form using a computer, the system will suggest a QR code so that the customer can take a selfie on their mobile phone. We recommend enabling this setting because mobile phone camera photographs are of higher quality than snapshots taken by computer webcams.