KYC for Customer Onboarding

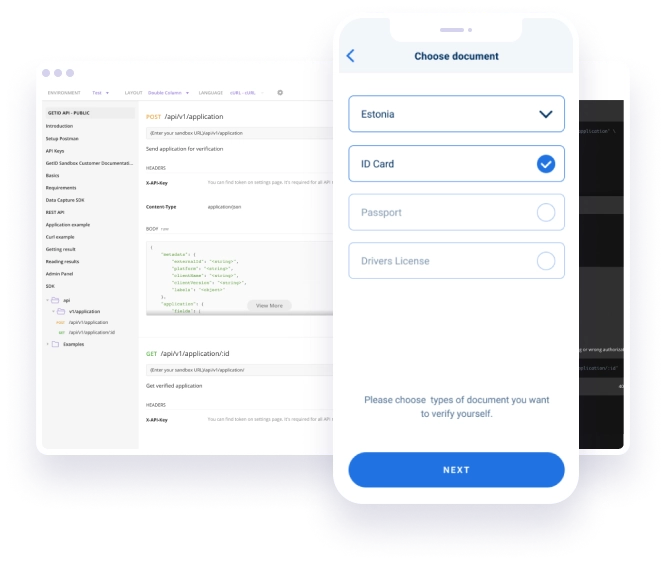

In today’s fast-paced world customers need to get instant access to products and services. Smooth remote onboarding process helps companies to create a superb customer experience while taking care of security and fulfilling regulatory requirements.

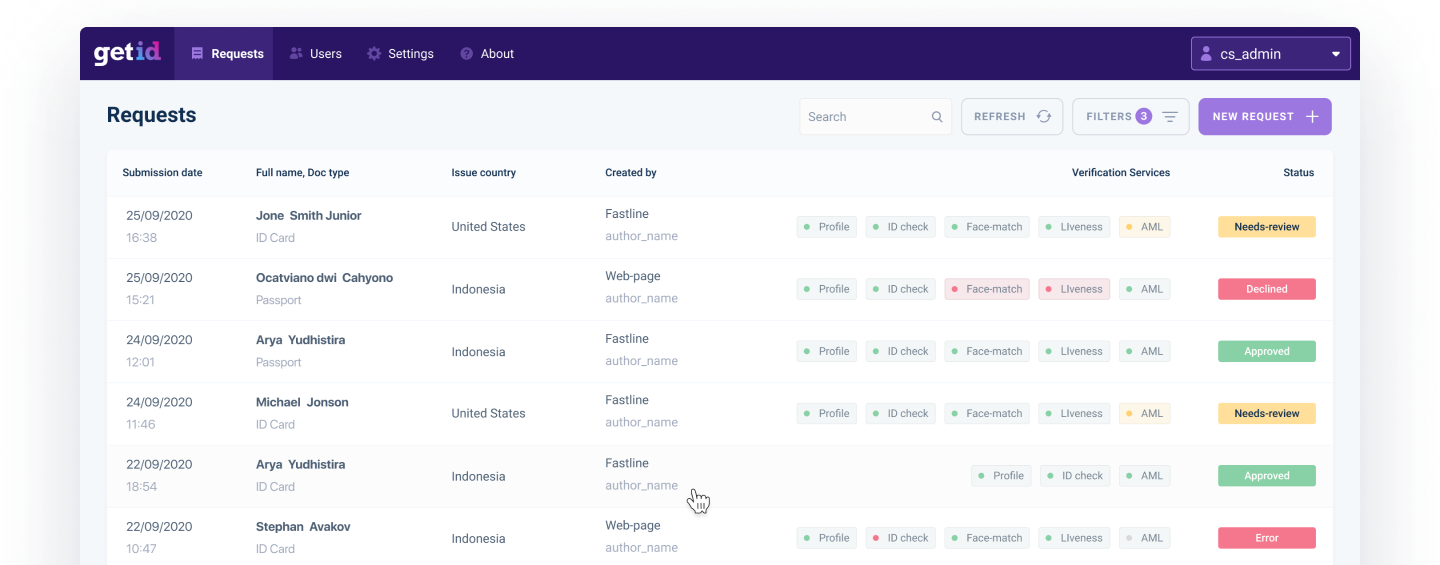

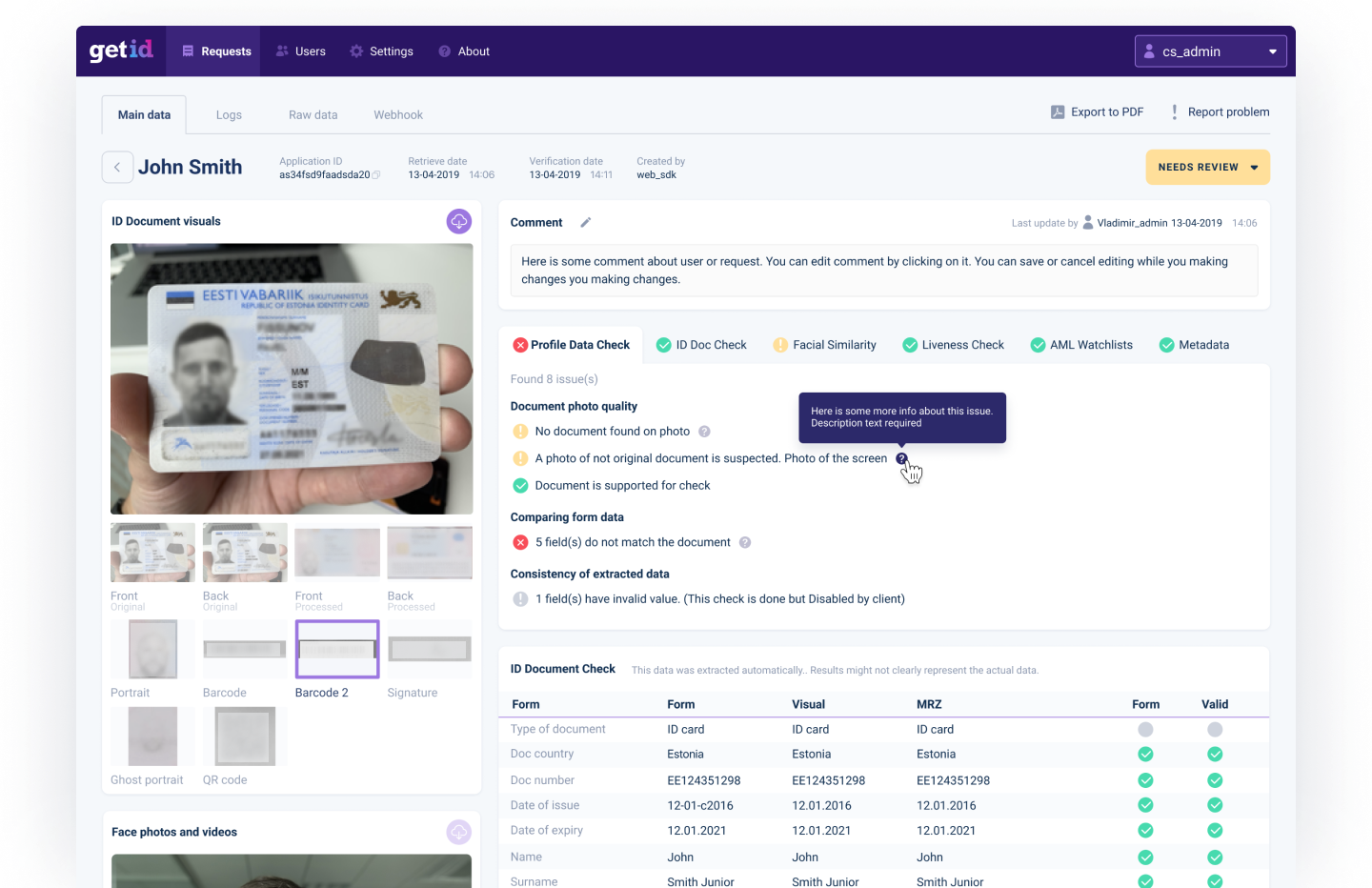

- verify clients identities in a matter of moments

- reduce manual error risk while using human power

- increase onboarding rates

- effectively prevent fraud

- stay compliant with AML KYC regulations