Identity Verification and KYC Solution for Trading and Investment companies

Streamline the onboarding process, prevent fraud and increase sign-up rates while staying fully compliant with AML regulations.

Streamline the onboarding process, prevent fraud and increase sign-up rates while staying fully compliant with AML regulations.

Expand your company’s geographic coverage to more than 190 countries, while remaining compliant with local and global regulations. Attract more trade-ready customers, reduce onboarding time through fast customer identification.

Reduce customer verification time to a few seconds by automating the KYC process. Minimise manual verification, relieve the compliance team of routine tasks.

Stay compliant with global regulators (FATF, FINMA, FCA, CySEC, MAS, FSA) by easily connecting to different regions of the world. We process 900+ document types from 190+ countries.

The cost of verifying customers can be reduced several times over by automating the process. Artificial intelligence handles thousands of requests a day, while a human handles no more than a hundred.

Admirals is the leading provider of financial solutions for the European securities market. The company serves over 30 thousand people a month from more than 130 countries.

The company has introduced automatic customer identity verification and the results have been impressive.

While even more important we have been able to open up new countries as a result of our ability to successfully verify clients from countries where previously we did not have such an option.

Head of Global Compliance at Admirals

Сompany has implemented automatic customer identity verification and as a result:

reduction in customer verification time

increase in customer conversion rates

Verify and authenticate ID documents at scale and in real time.

GetID is utilizing AI technology to verify a customer’s identity.

An algorithm compares a portrait from ID document photo with a selfie-picture and makes sure that they both belong to the same person.

Add another level of security to prevent fraud. Liveness Detection ensures that the users are “live” by asking them to complete a task on camera (smiling, blinking or turning their head).

This prevents users from fraudulently submitting pre-recorded videos, 3D masks, etc.

Close your eyes

Protect your business and reputation using risk-based approach. Check your customers’ data globally against 11+ million screened profiles.

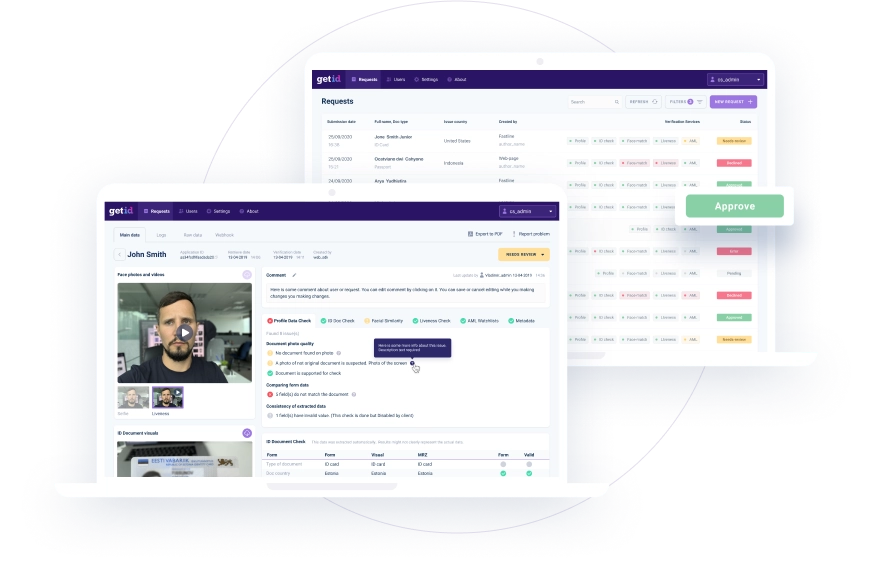

Cloud-based software with full access to verification results. Easily navigate and control your KYC and onboarding process at one place.

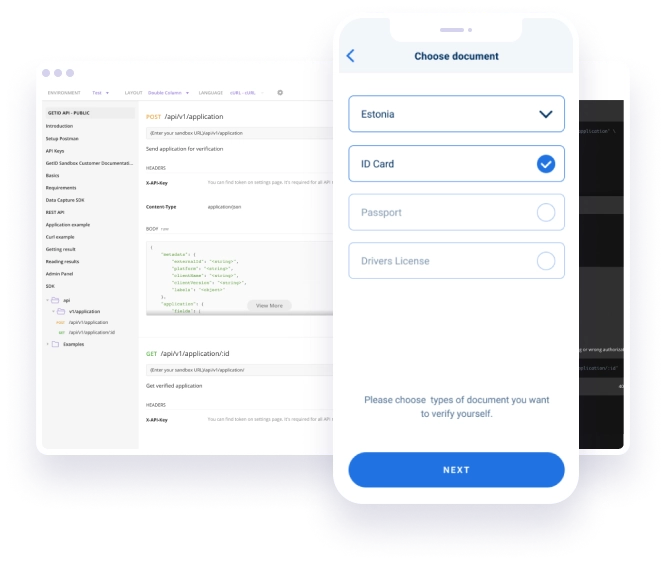

A range of set-up and integration options to fit your UI/UX:

Mobile SDKs

Highly-customisable iOS and Android SDKs built on native tech stack for a seamless onboarding experience.

Web SDK

Ready-made solutions for automated onboarding with fast set-up and easy configuration.

Cloud-based verification page

Send a link to customers and get verification results instantly in your Admin Panel or via webhook.

API integration

Integrate our KYC and customer verification solutions into your platform, collect data you need and get the results via API.

Read our related articles prepared by proven experts in the field

In today’s digital era, smartphones have become an indispensable part of our lives. With their widespread use, mobile identity verification has gained popularity as a convenient and secure way to remotely confirm identities. In this article, we will explore the concept of mobile identity verification, its benefits, and its implications for various industries. Mobile identity […]

In an increasingly digital world, identity verification is a fundamental requirement for accessing various services and participating in the global economy. However, a significant portion of the population known as the underbanked faces unique challenges in verifying their identities due to limited access to traditional financial services. This article explores the concept of id verification […]

In today’s digital landscape, ensuring secure and trustworthy identity verification is crucial. Blockchain technology has emerged as a game-changer, offering decentralized and tamper-resistant solutions for identity verification. This article delves into the potential of blockchain-based identity verification systems, their advantages, real-world applications, and the challenges they face. Let’s explore the world of secure identity verification […]