KYC Service & Identity Verification Platform

GetID is our all-in-one identity verification service that streamlines your customer onboarding process, ensures full regulatory compliance and reduces fraud. This makes us one of the top KYC services for businesses looking to expand globally. Try it now!

- Document Verification

- Face Recognition

- Liveness Detection

- AML Screening (PEPs and Sanctions Lists)

- Age Verification

- Proof of address

Trusted by

What kind of KYC Service we offer

Modern Identity verification software that helps you automate your KYC process. The service includes a collection of necessary checks, end-user interface customisation, an administrative portal and a metrics dashboard.

Stay compliant and mitigate fraud

Adhere to global and local regulations. Use reliable access to the most authoritative data sources. We support:

- 800+ PEP & Sanctions lists

- Adverse media monitoring data

- 1.6 million complete and detailed PEP profiles

Be secure already at the data collection stage. Make sure the documents provided are authentic and the selfies are real.

Global reach and fast results in real-time

Easily onboard customers worldwide. We support:

- 14000+ ID Documents from 190+ countries

- 80+ languages

- Latin & Cyrillic fonts

- Diacritical symbols

Detailed reports and intelligent analysis help you make fastercustomer decisions.

Fast, easy and secure integration

Whether you’re an SMB or an enterprise, GetID provides you with all necessary tools to:

- set up a preferred identity verification flow

- customize the design of a user journey

- integrate across all platforms in the shortest time frame.

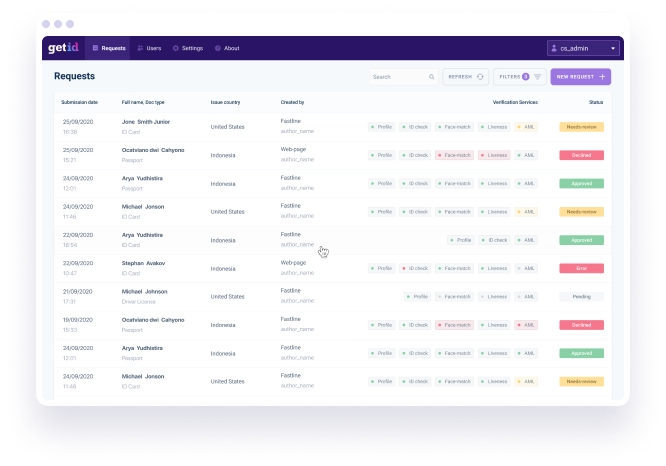

Increase operational efficiency

GetID verification platform enables you to automate the verification process and reduce your compliance team’s workload.

- 60 seconds to verify a customer

- 95% pass rate on the first try

- Statistics dashboard for better visibility and control

The Admin portal’s intuitive interface is easy to use and allows KYC & compliance teams to effectively handle big numbers of requests.

The complete toolset for Identity verification and KYC service online

We believe reliable identity verification requires more than one technique. Our KYC service combines multiple verification methods to strengthen fraud detection and help your business maintain strong regulatory compliance

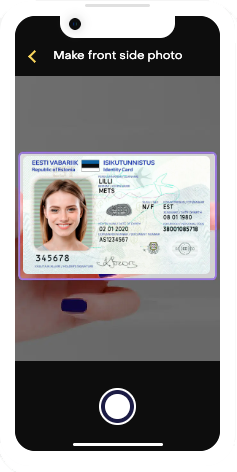

Identity verification through ID Document checks

Verify user identities and documents in a matter of moments for quick customer account opening and risk mitigation. Save time and reduce operational costs.

- 14000+ ID Document from 190+ countries and territories

- Advanced OCR for precise data capture and extraction

- Document Authenticity Checks by skilled experts

Flexible and secure software that can be easily integrated into your workflow.

Advanced Identity Verification Software Features

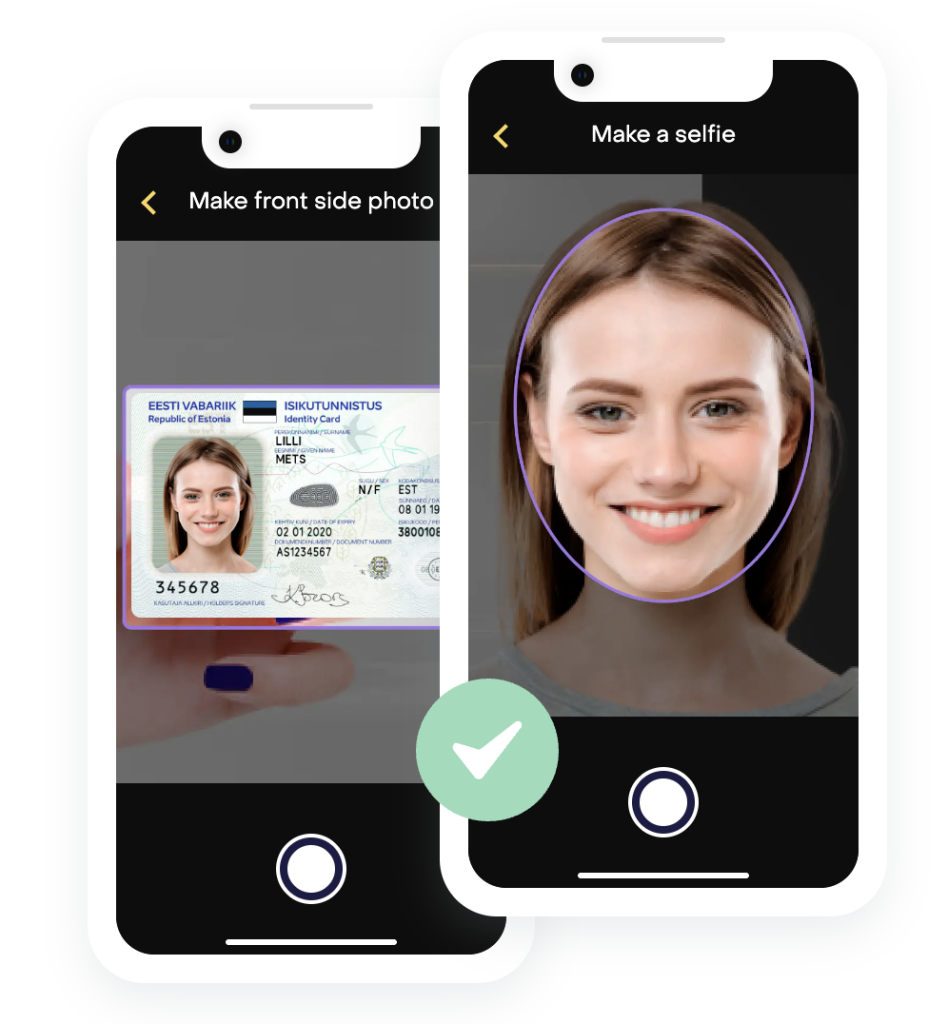

Face Recognition Service

Make sure the customer’s selfie is matching with the customer’s photograph in the uploaded identity document during verification.

- State-of-the-art detection technology powered by AI

- Instant result

If your KYC process requires selfie matching, you should connect to this service. Using artificial intelligence and the latest detection technologies, the system will determine the biometric parameters of the customer’s face and provide the result within one minute.

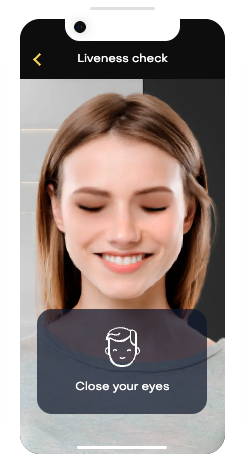

Liveness check

Ensure that the customer is the same live person as indicated in the identity document being verified. For that, the customer has to perform several actions on camera.

- The most powerful anti-fraud tool

- Verification results are recorded and can be extracted for further usage

Add another level of security to prevent fraud. Onboard more honest customers with confidence.

AML Watchlists Screening

Easily manage the risks, perform Customer Due Diligence and follow the best security standards. Check your customers’ profiles across:

- 800+ Sanction lists

- 1.6 million complete and detailed PEP profiles

Your KYC officer can use this information if the customer verification process yielded a negative result.

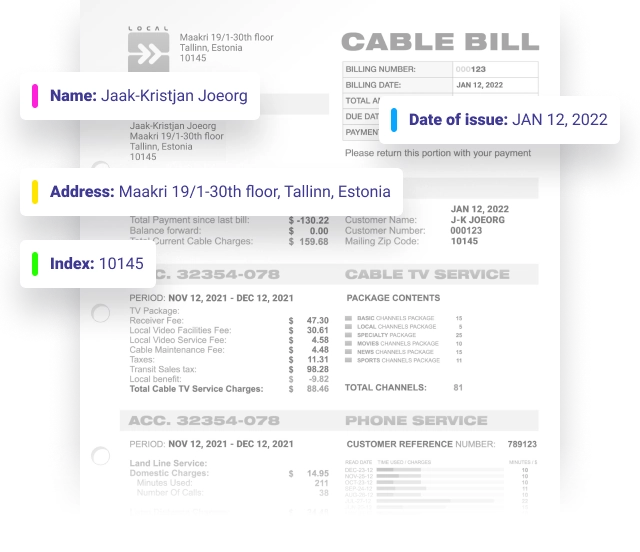

Residential Address Verification

As a step in the Identity verification process you can make sure that the person lives where they claim to live by checking acceptable PoA documents: utility or mobile phone bills, bank statements, governmental correspondence and others.

The service includes:

- Easy uploading of different documents

- Instant recognition and extraction of important data

- Detailed report with photo evidence

- Reports are delivered to your system

Real-time address verification takes only a few minutes for the client.

How it works

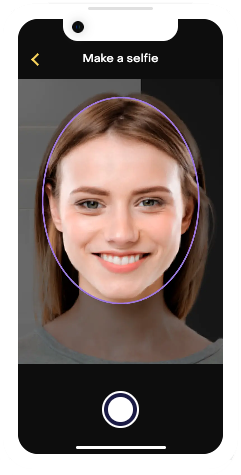

Step 1

User photographs their ID from both sides

Step 2

User takes a self-portrait with their smartphone camera or webcam

Step 3

User performs some simple movements for liveness detection purposes

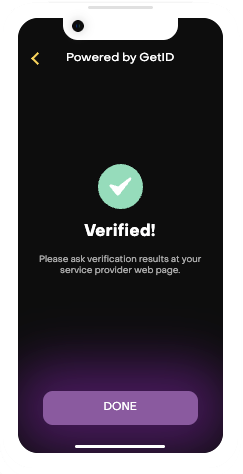

Done!

User is verified, onboarded and ready to go

What our clients are saying

This is a service that gives us absolutely what we need. The integration is fantastically fast. GetID is just a great find…

Michael Desforges

CEO of Telexoo

GetID has helped us to get rid of potential fraud within our system and create a robust process to ensure that we minimize fraud in our base…

Mishaan Ratan

Chief Marketing Officer and Co-founder

GetID is a solution that gives value for money…

Noel Bartolo

Chief Compliance Officer & MLRO

GetID’s interface is simple and straightforward: a good balance of simplicity and complexity. It is great for both the developer and the person who knows very little…

Jose Baptista

Partner UK Tax Return

The GetID [identity verification] platform has provided us [E. Gulbja Laboratorija] with the functionality that we needed. GetID understood our needs and provided…

Valdis Gavars

Software Developer & IT project manager at E.Gulbja lab

GetID’s document verification solution has been seamlessly integrated into our onboarding process for new customers. The extensive capabilities of the API…

Valērijs Bikovs

Head of Internal Automation Department

While even more important we have been able to open up new countries as a result of our ability to successfully verify clients from countries where previously we…

Andreas Ioannou

Head of Global Compliance at Admirals

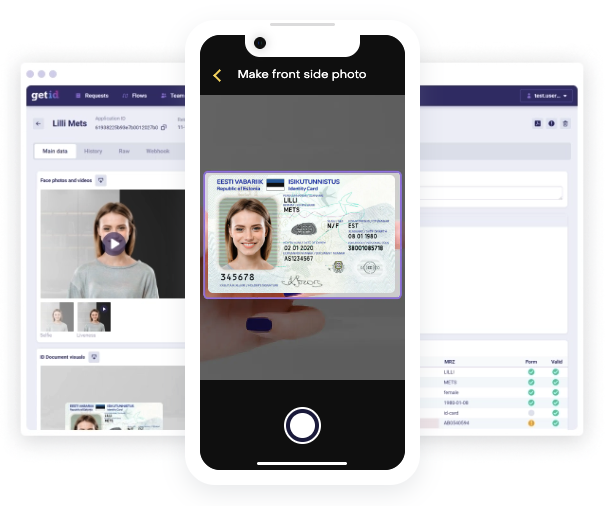

An all-in-one KYC software at your fingertips

Manage your processes and collaborate seamlessly with team members with an easy-to-use dashboard that gives you complete control, wherever you may be.

- Verification results and status overview

- GDPR-compliant customer data storage

- Real-time monitoring

Seamless integration with your business ecosystem

A range of set-up and integration options to fit your UI/UX:

Mobile SDKs

Highly-customisable iOS and Android SDKs built on native tech stack for a seamless onboarding experience.

Web SDK

Ready-made solutions for automated onboarding with fast set-up and easy configuration.

Cloud-based verification page

Send a link to customers and get verification results instantly in your Admin Panel or via webhook.

API integration

Integrate our KYC service and Identity verification solutions into your platform, collect data you need and get the results via API.

Easy-to-use KYC software with no-code integration

GetID:s KYC service flow builder helps you automate and personalize online KYC and identity verification procedures according to your company onboarding process and specific regulatory requirements.

- Select the necessary document and identity checks for your process

- Customise the form fields in an intuitive editor interface

- Modify/customise the visual appearance to suit your brand-specific style

- Easily integrate our software into your website, application or entire customer system

Ready to get started?

Let us know what solution you are looking for. We’ll make sure to provide the best possible offer!