Verification of ID Documents Online – how does it work

19 Oct 2022

Introduction

Identity theft is a growing concern for governments, consumers, and businesses. The Research and Strategy institute, Javelin Strategy, discovered that identity fraud resulted in losses of up to $56 billion in 2020 alone. While identity fraud scams have been reducing every year, the severity of these incidents is on the rise and shows no signs of slowing down.

In fact, cybercriminals are finding new ways to fool businesses through identity fraud. A new form of identity theft, known as synthetic ID fraud is growing rapidly in the US. Mckinsey considers synthetic ID fraud as the fastest growing financial cybercrime in the United States, taking over credit card frauds.

Even on a personal level, people suffer from identity theft indiscriminately. Just in 2018, as many as 60 million Americans became victims of identity theft. Most scams are carried out online, making it difficult to track down cybercriminals.

Online services including brokerages, banks, crypto, casinos, and even businesses offering age-restricted products must verify IDs online. Since businesses need to perform customer onboarding remotely, scammers exploit this to get away to identity theft and a range of other financial frauds.

The Anti-Money Laundering (AML) regulation enforces these businesses, especially financial services to perform ID verification accurately, levying them with large fines if they fail to do so. Online ID verification offers a reliable way to fight fraud and limit unauthorized access, helping businesses curb the rising tide of financial fraud and identity theft.

Online ID verification helps us verify IDs over the internet. Therefore, businesses no longer need in-branch, in-store, in-person verification, and they can easily shift the entire process online. It allows businesses to safely perform customer onboarding online. With online ID verification, businesses are not only safe from financial and identity fraud, but can also meet statutory obligations, such as Counter-Terrorism Financing and AML.

When does ID document verification come into play?

Regulations are becoming increasingly stringent to meet the rising demand for security and protection in financial services against identity fraud. Financial and other services struggle to curb the rising tide of fraud. Therefore, to understand why we need document verification, we must understand the regulations that pushed businesses to online ID verification: AML and KYC.

Anti-Money Laundering (AML) and Know Your Customer (KYC) are compliance procedures enforced by law. They help companies mitigate risks of banks and financial services to reduce the possibility of financial crimes.

The process involves numerous monitoring, verification, and cross-checking procedures. Policies to prevent fraud must be free of vulnerabilities to prevent cybercriminals from slipping through. If businesses fail to meet recommendations from both regulating bodies, they are subjected to heavy fines for non-compliance.

Although both AML and KYC are used interchangeably, they are different terms. AML is an entire framework for preventing malicious financial practices, whereas KYC is a set of procedures specifically related to identity and document verification.

Businesses need online ID verification to meet regulations set by the KYC procedure. For regulated businesses, online ID verification is a mandatory part of the customer onboarding processes. On the other hand, non-regulated businesses (i.e., selling age-restricted products) must implement online ID verification for remote customer onboarding, in order to verify customers’ age and keep under-aged users away.

To give you context, customers must provide copies of their passports, photo ID as well as social security numbers each time they open a new account in an online bank, casino, or brokerage firm.

In a multi-stage operation, KYC procedures also involve customers and direct financial services to collect and analyze customers’ ‘Personally Identifiable Information’ (PII) to curb malpractices. Experts call this stage Customer Identification Program (CIP).

Businesses must collect information such as their full name, date of birth, and address. Besides that, customers must submit their government-issued ID to verify that it’s valid, authentic and belongs to them. In general, customers are asked to provide either ID card, passport, driver’s license or residence permit.

What Are the Challenges of Manual ID Verification?

Organizations consistently rely on manual document verification to secure client information and meet regulations set by AML. However, performing ID verification manually hurts in more ways than it helps.

Vulnerability and Loss of Reputation

Several branch employees and tellers were caught using personally identifiable information for fraud schemes after they collected the information for manual data verification. Prosecutors have discovered that they have to deal with one case every month where tellers were involved.

When customers find that people they trust are using their information for fraudulent schemes, it erodes their trust. Consequently, if this happens at your company, not only will it break your customer’s trust, but it will also plummet your business’s reputation, hurting your business in several ways including losing customers in all directions.

Challenges in Entering New Markets

Financial services breaking into new markets will discover an entirely different set of challenges. They must traverse unchartered territory and go to significant lengths to nurture a relationship of trust and confidence amongst new customers.

Therefore, these businesses must be quick on their feet and find ways to accelerate market capture. For this, they must expedite fraud prevention through ID verification. Unless you move quickly and capture the market, someone else will take your place and replace you. However, manual ID verification can become a significant hurdle in this.

Businesses need an ID verification process that has the potential to grow fast. A manual procedure creates a bottleneck that blocks your efforts to bring in as many customers as possible.

In these situations, a business is trapped either way. If it loosens restrictions or expedites the manual verification, it will increase the number of errors or let malicious users inside their network, incurring the wrath of regulating authorities and piling up back-breaking penalties on your business.

You can temporarily alleviate this issue by hiring additional staff, but the issue will continue to haunt you as long as you persist with manual ID verification.

Extra Cost

Although you have to pay for online ID verification software, it’s negligible in comparison with the cost of maintaining a fully human workforce. Human resources are one of the highest costs for any business.

You spend a ton of time, money, and resources on hiring and training them, pay monthly wages and benefits, as well as, annual or biannual incentives to retain them. With all this, you can’t guarantee that they will stay with your company and help revenue grow in the coming years.

Therefore, if your company uses manual verification, you must consider your employees as a direct cost. Although it’s impossible to replace your human staff because of their value within your organization, you can utilize them much more effectively when they are not trapped in strenuous manual processes.

This is especially true for employees highly trained in compliance. Using these people in running verification checks doesn’t do justice to their talent, position, or skills. Instead of wasting their time and efforts on dull tasks like manual verification, you can utilize their core competencies in other valuable tasks.

Adopting an online ID verification software will help you automate ID verification and customer onboarding. Additionally, since your staff is only doing what they do best, it boosts their morale and improves their job satisfaction.

Slow Processing

Business managers recognize the importance of moving ahead with full speed. You need a system that saves you time in several processes, helping you outmaneuver your competition. However, manual ID verification is the opposite of what you need to grow.

Manual ID verification is known to be extremely slow and tedious. Your staff needs to go through every piece of the document themselves and verify them one by one. Humans naturally suck at multi-tasking. Instead of helping us cover more work, it kills productivity.

Therefore, when your staff needs to shuffle between several documents to verify if they’re genuine, it drastically affects their productivity. The stress and burden of multi-tasking sap their energy, pushing them in doing less day by day. This unnecessary waste of time and human effort hurts your business and makes manual ID verification take even longer.

Cost of Human Error

It doesn’t take a genius to understand that overburdening your staff will force them to make mistakes. Even if you’re a great manager and divide the load efficiently, you can never avoid human error.

We, humans, are not robots. We cannot do one task a thousand times and do it the same way every time. It’s hard for us to maintain the same level of efficiency over time and we are prone to making mistakes once every now and then.

In contrast, automated tools can work at tasks relentlessly, without making mistakes or being exhausted. When we verify information manually, we must enter data manually, creating room for errors in our system.

These errors result in false rejections during verification checks, forcing your staff to reenter information. Even worse, your staff can reject legitimate customer accounts, increasing your costs, leading to a loss of revenue, and leaving a stinging customer experience.

Alternatively, a potential money launderer can creep into your system, creating mysterious anomalies in audit trails. These seemingly minor occurrences can cause significant damage to your company, especially in terms of reputation.

An Obstacle to Global Outreach

Online businesses often sell products and services to a global audience. As a result, they must enroll customers from all corners of the world. A global outreach takes business growth to a whole new level.

However, it also presents businesses with a unique set of challenges. Businesses must deal with multiple types of ID documents of customers belonging to several different countries. Here, a manual ID verification system is not only insufficient but an obstacle to expanding your business globally.

To maintain an international level of standard, you need a reliable document verification service that enables you to verify thousands of ID document types. You must be able to verify documents online, in real-time, and have global coverage, as well. The solution must support languages, scripts, and character recognition from multiple ID Document types.

You must look for ID verification software that makes it easier to scale your service based on your needs. Whether you need to verify 1000 ID documents every month or 10000, the solution must meet your requirements seamlessly.

Sometimes, businesses need experts specialized in ID document processing to catch synthetic ID fraud. For this, they must adopt a hybrid automated-manual approach to benefit from the expertise of specialists. Your ID verification tool not only needs to automate tedious tasks but also provide support in manual help. Moreover, businesses need flexible integration options, to ensure greater functionality and better performance.

Document Verification Process – How GetID Verifies ID Documents online

Traditionally, online financial services must verify user IDs online through device IPs, phone numbers, or credit database look-ups. However, cybercriminals can exploit these measures and use fake IDs to carry out fraudulent activities. This constant uncertainty is distressful for businesses, as they must spend a significant amount of time, effort, and money verifying information, giving them less time to enhance user experience or provide better services to customers.

GetID uses a sophisticated system of cutting-edge technologies to ensure you can verify ID documents online seamlessly. It allows you to expedite customer onboarding and create trusted user IDs, reducing operational costs, and driving greater revenue. Using Biometric Verification, it enables your business to tie a user’s account to his or her real ID.

With an intuitive interface and seamless workflow, GetID gives your customers an excellent user experience and eliminates bottlenecks that cause drop-offs.

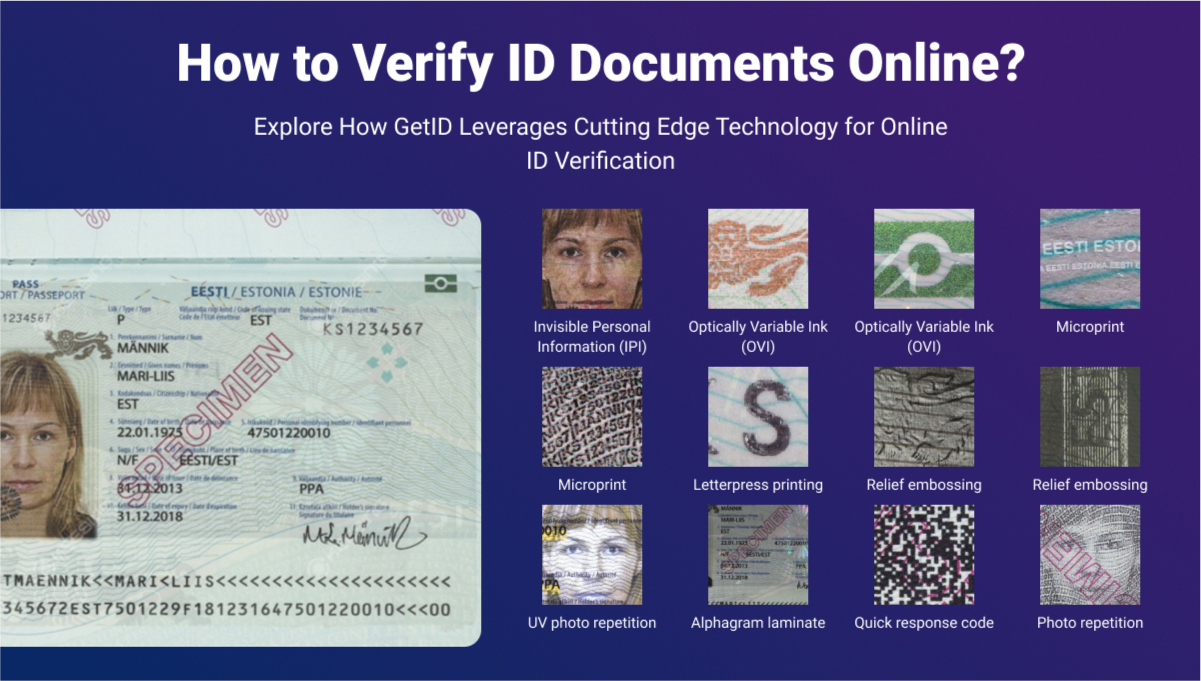

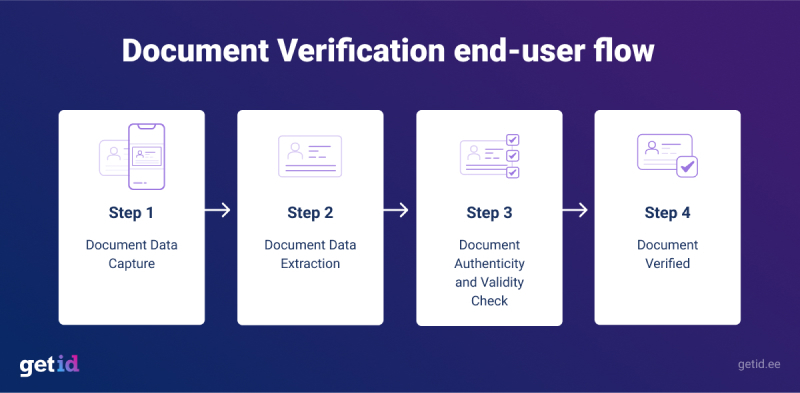

Here are the steps we take to identify malicious users and accelerate customer onboarding:

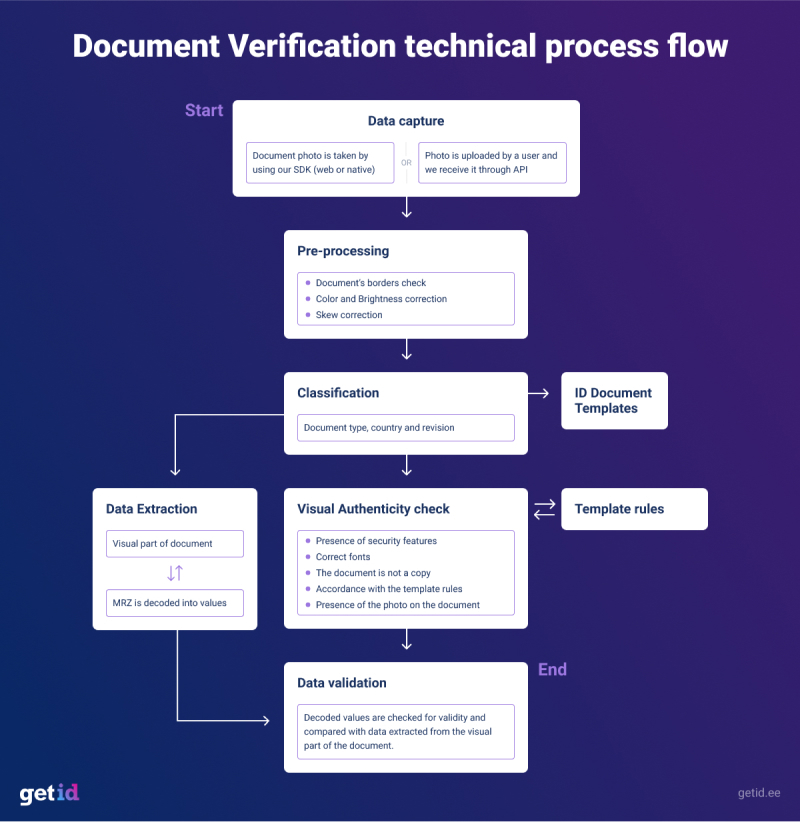

Data Capture

Data capture is a cutting-edge process that replaces manual data entry with the help of advanced AI and OCR technology. GetID’s online interface allows you to take a photo through the application’s web or native SDK. Once you do that, you can upload it and we will receive it through our API.

Pre-Processing

Before sending your ID photo for further processing, the system will ensure that your ID document is in the correct state. It will check borders, color, and brightness while making corrections simultaneously.

Classification

Here is where it gets tricky. In this step, our solution employs AI to detect the type of your ID document, the revision, issuing country as well. In addition, the system checks the document photo quality, if it has any blurs, glares or dark spots. The system would check if the image of a document is a real document and not a scan, photo of printed out ID document, screenshot or a photo of a screen.

Match Document with the official id document template

Based on the system’s analysis, the system retrieves the record of similar documents saved in the database of official document templates. Based on that, it will determine several things, such as:

- Document size

- Side aspect ratio

- Relevant data points

- Whether you must submit the backside photo of the document

- The information saved in the document, coordinates, boundaries

With these rules, our solution will analyze the attributes mentioned above and compare the customer’s ID document with the official sample.

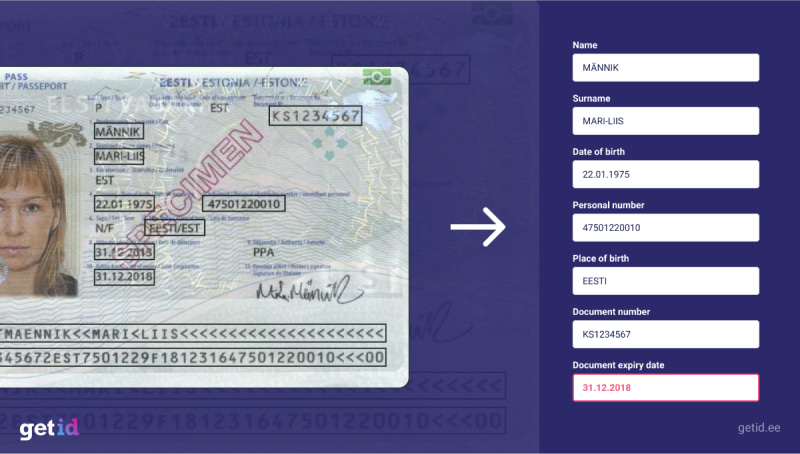

Data Extraction

Using predefined rules from the ID document template, our solution extracts data points from input fields, barcodes, portrait, and MRZ as long as the scanned ID document template contains this information. This allows the application to extract and process the visual and MRZ zone simultaneously based on the document’s type.

At the same time, the system will analyze the document based on the overall checksum, 1/2/3 lines, the number of characters, and overall MRZ checksum, the checksum of the date of birth, the checksum of the document number (if there is one), or checksum of the expiry date (if there is one) and others. This is where the system uses advanced OCR to extract text from your photo with pinpoint accuracy.

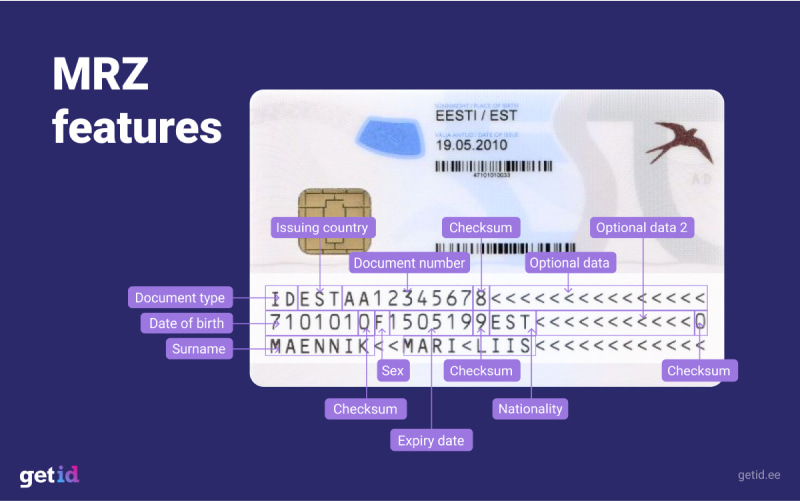

Decoding MRZ

Following that, we decode MRZ into values based on the rules we feed (more on MRZ later).

Data Validation

The system verifies the validity of decoded values by comparing them with the data extracted from your client’s ID document.

Search for Human Portrait Photo

The system searches for human portrait photos. This step becomes useful later when the system must compare the photo with the selfie your client provides. Using the imposter detection function, we can identify if the portrait is modified and contains the face of another person.

Verify Security Features

The system looks for additional security features it has extracted from the document, such as ghost image, patterns, fonts, holograms, signature, photo, QR code (if there is one), barcode (if there is one).

Check Document Expiry Date

The system checks the document’s date of expiry.

Verify User Profile

Using the document data, the system checks the user’s profile and highlights any differences it finds.

Compare Selfie Photo

The system asks your clients for selfie photos along with the ID document verification. The system will then compare the selfie photo with the portrait on the document and verify if both pictures are from the same person or not.

Using computer vision, it will analyze photos and calculate the estimated percentage of similarity. You can set up thresholds based on your requirements, rejecting or accepting photos if they fail to match.

Liveness Detection

Add another level of security to prevent fraud. Liveness Detection ensures that the users are “live” by asking them to complete a task on camera (smiling, blinking or turning their head). This prevents users from fraudulently submitting static printed out portraits, pre-recorded videos, 3D masks and using other attack vectors.

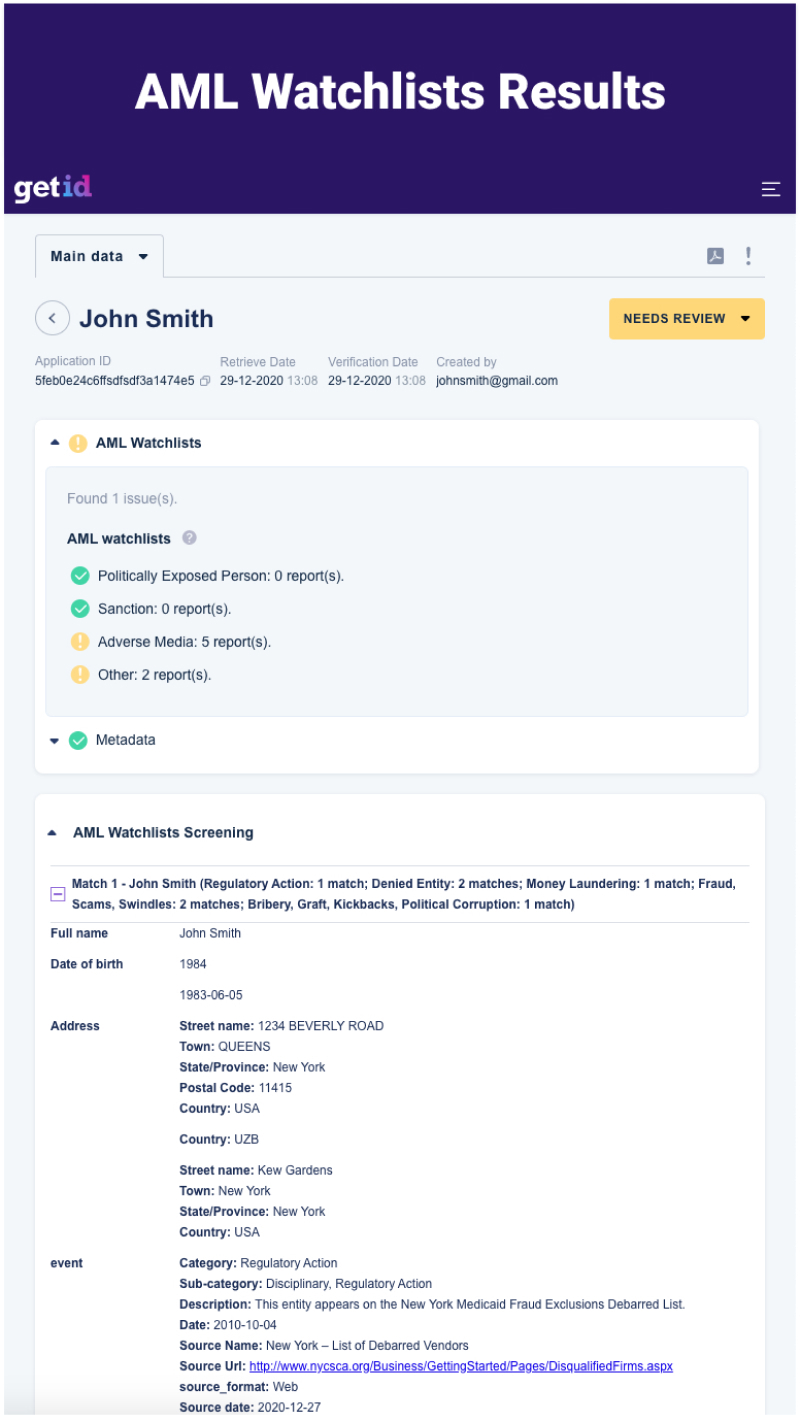

Match With AML Watchlists

The system analyzes user data and matches the data with AML Watchlists, helping you identify cases labeled for PEPs sanctions and Adverse media. You can also perform complete or partial matches for both phonetically similar names or similarly spelled names. Watch our AML data structure:

Checking Controversial Cases

When your system detects controversial cases, they are highlighted and sent for further document verification. The system will perform further ID document checks and biometric face-matching investigation through manual verification of specially trained staff. Our qualified ID verification staff is trained by ex-Interpol and border control experts.

What is MRZ?

Machine Readable Travel Documents issued in accordance with the ICAO Document 9303 include Machine Readable Zone (MRZ). It is a specific area of the ID document that holds a person’s data in encoded form.

MRZ is most used in travel documents such as passports and is an excellent way to conceal confidential information. It reduces the processing time of travel documents by making it easier for software to inspect travel documents.

In most cases, MRZ is printed in two to three lines in an OCR type B font. Documents containing MRZ codes are known as Machine Readable documents because only a machine can read the information saved in the document.

It uses “checksums” to verify MRZ codes. Checksums are mathematical data points created to identify errors and to check if the information has been modified. By analyzing the MRZ code, an intelligent ID verification solution can detect forged documents.

MRZ code verification plays a key role in eliminating the chances of forgery and prevents unauthorized alteration in the IDs. Therefore, you can accelerate the ID verification process easily.

How the Machine Reads MRZ Code?

By using a special reading device, the system detects MRZ code and extracts information encrypted inside. The system majorly relies on OCR for extracting data from the documents. Once OCR scans the document, machine-readable data is stored in the electronic format.

After that, the system parses the information saved on the document based on the data fields listed on the document. OCR also helps to calculate the checksum of extracted data from the ID card. Thereafter, the system compares the calculated checksum with the original checksum of the card’s data to ensure that it’s not forged. You can also extract this information from another device to investigate further.

What is OCR?

Optical Character Recognition (OCR) is a machine learning technique that detects and extracts text within scanned documents, images, and even photos. Intelligent OCR solutions can even help you classify documents after analyzing them. It is so powerful that it can convert text from images into machine-readable text whether it is printed, typed, or handwritten.

Needless to say, OCR plays a huge role in the identity and document verification industry due to its data extraction abilities. It is the golden standard for ID verification and is essential for accelerating ID verification.

Developers incorporate OCR to extract personal information like an ID card number, date of birth, name, address, gender, and other customer details within seconds, automatically reducing processing time, as a result. Moreover, it needs little information from end-users, making it ideal for systems that solely rely on automation and need manual intervention.

Advantages of Online ID Document Verification

Online ID document verification offers several advantages. To start off, it allows businesses to analyze documents almost instantly, accelerating customer onboarding significantly. By detecting fraudulent IDs accurately, it prevents ID theft and fraud, saving businesses from financial and reputational losses.

Since the solution is device independent, you can use it across several platforms, enabling business to integrate it easily with their business processes. Additionally, online ID document verification comes with a customizable flow, giving businesses additional services such as a hybrid approach of automated and manual ID verification.

Benefits of using GetID solution

Manual ID verification has several disadvantages. Adopting an online ID verification software will help you automate ID verification and customer onboarding. The solution not only provides you a faster turn-around but also more accurate results, out-performing manual ID verification by a huge margin.

Global Coverage

GetID allows you to maintain an international level of standard, by helping you verify thousands of ID document types. You must be able to verify documents online and enjoy a solution that supports languages, scripts, and character recognition from multiple ID Document types.

The solution supports more than 7000+ types of documents with access to more than 223+ territories and countries. GetID verifies ID documents online, including passports, ID cards, driver’s licenses, and residence permits, helping you and your team build a truly global presence.

Scalability

Verifying ID documents manually becomes increasingly complex over time. You must invest significant time, money, and effort in training your team and paying for their operational costs.

Yet, as your customer base grows, so does the burden on your team. The increasing load can quickly overwhelm them. This is why it’s wiser to invest in an intelligent ID verification solution early to benefit from its ability in earnest. You can scale your services on demand and reap benefits in the long-term.

Accurate ID Verification

Extracting data from ID documents is important. To automate ID document verification effectively, you need a solution that categorizes the extracted data and transfers it to relevant data fields. ID documents have multiple fields containing valuable information. Therefore, detecting the file type and verifying it accurately is not easy.

You need a system that helps you reliably transfer data from digital and tangible to their ID document verification system without any oversight or manual intervention.

An ID document verification solution like GetID helps you determine the type of document precisely. Our solution processes and analyzes files from different formats and helps you avoid compliance issues and penalties effectively. Using cutting-edge technologies like OCR GetID allows you to verify documents accurately.

Cloud Access

Similarly, cloud access is also a useful feature in automated ID document verification. Cloud-based document verification solution lets businesses run business operations from anywhere and add multiple users with ease.

Instead of being restricted to an on-premise solution, cloud access lets you make intelligent ID verification features easily accessible from anywhere, anytime. Therefore, remote workers can easily use these features to keep your business afloat during social restrictions.

Integration Options

Unless your ID verification solution has support for export and integration of documents and data, your company can become limited due to the lack of integration code. GetID offers you pre-built export connectors allowing you to link with common destination systems and integrate with unsupported systems.

We provide users with various setup and integration options, including:

iOS and Android SDKs

Our solution is available on both Android and iOS technology stacks, allowing businesses to leverage highly customizable SDKs and provide their customers a frictionless onboarding experience on mobile.

Web SDK

GetID’s web SDKs allow you to integrate onboarding on your website through its robust web SDKs.

Cloud-Hosted Web-Page

Use webhooks and Admin Panel to receive results and share links of client verification.

API

Collect needed data for identity verification and KYC and receive check results via API.

Excellent User Experience

The system assists your customers as they take photos of their ID documents. If the photo is blurry in some way then the system takes its time and only clicks when the photo quality is the best. This feature allows you to extract data faster and provide users with a greater user experience. The onboarding process is not only smoother but also produces higher conversion rates.

Consistency

Contrary to popular belief, ID documents aren’t created with the level of consistency many people expect. Differences in materials, printing alignment, document quality, and color variance all affect the verification process.

ID cards issued by the government can differ from each other with each batch as governments assign orders to different manufacturers. This is why you need an intelligent solution that helps you incorporate risk tolerance verification levels allowing you to verify ID documents accurately without generating needless false positives.

Customizable Workflows

Every business has different dynamics and companies need to leverage a range of different procedures for customer onboarding and ID verification. This is why GetID offers its users customizable workflows. Our team of experts can help you build customized workflows, enabling you to perform frictionless identity verification according to your business needs.

Faster Compliance Resolution and Onboarding

Compliance issues can damage your company’s reputation and hurt it financially. Strict regulations like the AML impose huge fines on businesses that fail compliance. Our solution gives your compliance team a detailed dashboard where they can track verification real-time and accelerate ID verification significantly. As a result, your business enjoys a faster workflow, allowing you to serve customers seamlessly and drive greater revenue.

Conclusion

As scammers find new ways to exploit vulnerabilities in financial services, businesses must step in to meet their challenges. GetID provides its users with the perfect set of tools to combat identity fraud and other financial crimes. Automated KYC solutions offered by GetID.com can help your business minimize delays, can cut costs, and avoid human errors due to manual ID verification. With our solution, you can better manage compliance requirements from AML and automate KYC processes without a sweat.