Fully customisable KYC software with no-code integration

KYC flow builder

GetID KYC flow builder helps to automate and personalise online KYC and identity verification procedures according to specific regulartory requirements.

- Define needed checks

- Customise the design of the user journey

- Set up and integrate in hours, not in days or weeks

- Monitor and update on-the-fly

3 steps for KYC automation

Explore how GetID KYC software makes it easy to automate your KYC process.

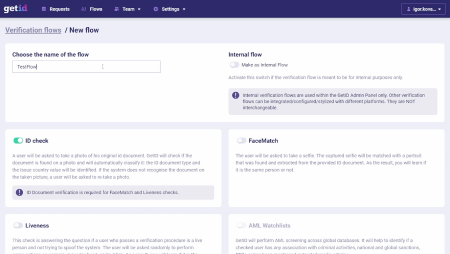

Step 1

Create one or multiple onboarding flows for your customers. Define needed checks according to specific regulatory requirements.

Step 2

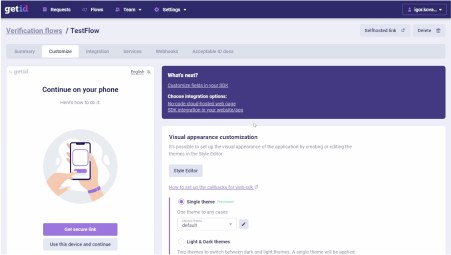

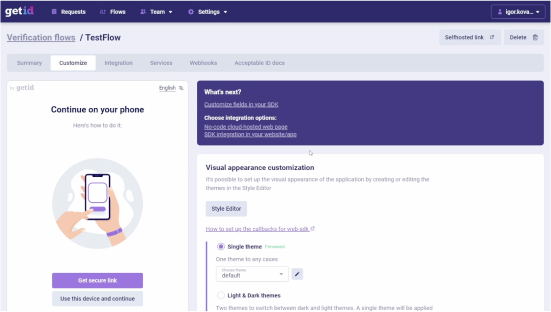

Customize the visual appearance of the user journey. Use your company’s brand palette to make the form look native in the interface of your app or website.

Step 3

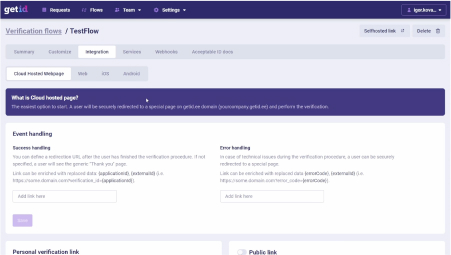

Easily and securely redirect clients to personalised cloud-hosted verification page or integrate verification journey in your website or app.

Benefits of using GetID KYC software

Use GetID KYC Software to make it easier to automate the identification process in your company.

- Easy integration and fast implementation

- Сross-platform solution can be deployed on web, native iOS and Android

- Flexible configuration of different checks for specific products and/or countries & jurisdictions

- Easy design and interaction customisation for better UX

Online KYC/Identity Verification flow builder is accessible via GetID Administrative portal, which can also be used as an easy-to-get-around work environment for KYC officers and compliance teams. Multiple verification flows can be set up, deployed on the fly, and function asynchronously.

Track changes of your flows on the fly

Our KYC software lets you easily create multiple verification processes for one company.

According to your risk management and the requirements of your regulator, you can set up several verification flows.

For example, the KYC flow for high-risk countries can include original ID document verification, face matching, liveness check and AML Screening. Whereas, the KYC procedure for low-risk countries can consist of id document verification and AML screening.

Different verification flows for Compliance teams

Configure the required interface changes and observe them in real time. KYC Flow Builder allows you to customize customer form fields and ID document fields, selfies type, and design solutions. No coding is required.

Several viewing formats are available: a desktop version and a mobile device version. The latter helps you assess whether the form will be displayed correctly in your mobile application.

GetID’s document verification solution has been seamlessly integrated into our onboarding process for new customers. The extensive capabilities of the API…

Set up identity verification flow

GetID offers four basic KYC process services. You simply select those that your company needs. You can select all checks at once or choose only those that you need now and connect others later. For instance, you can use only verification of uploaded identity documents without any data entry forms for customers, or AML screening in global databases.

ID documents verification

Verify and authenticate ID documents at scale in real-time. This is the basic and most frequently needed verification type. The uploaded identity document is processed in a matter of seconds.

AML Watchlists Screening

This verification is compulsory for financial organisations. GetID checks the customer in all global law enforcement databases, sanctions lists and PEP lists, and searches the mass media for any mentions. Your KYC officer can use this information if the customer verification process yielded a negative result.

Face Matching Service

The system will compare the customer’s selfie with the customer’s photograph in the uploaded identity document. If your KYC process requires selfie matching, you should connect to this service. Using artificial intelligence and the latest detection technologies, the system will determine the biometric parameters of the customer’s face and provide the result within one minute.

Liveness Test

The system will determine whether the customer is the same livе person as indicated in the identity document being verified. For that, the customer has to perform several actions on camera. This is the most powerful anti-fraud tool. The verification results are recorded and can be extracted for further usage in your system as the instant result.

Got questions? Talk to our team!

Customise the visual appearance

GetID KYC Software makes the verification procedure seamless for your customers by using a UI style editor. No coding is required.

- Widget size, background and accent colours

- Text colours, sizes and font-related customisation

- Buttons, inputs and other UI elements

In both cases you can amend the design of the verification form. Create a form matching your company style or use the GetID library.

You can change the size, background plus customize to your company style for better UX. You can apply your brand-specific colours. Any change can be immediately checked in the configurator.

I really recommend GetID to any company that has to verify its clients during the online onboarding. It is a great solution to implement in your business as it is…

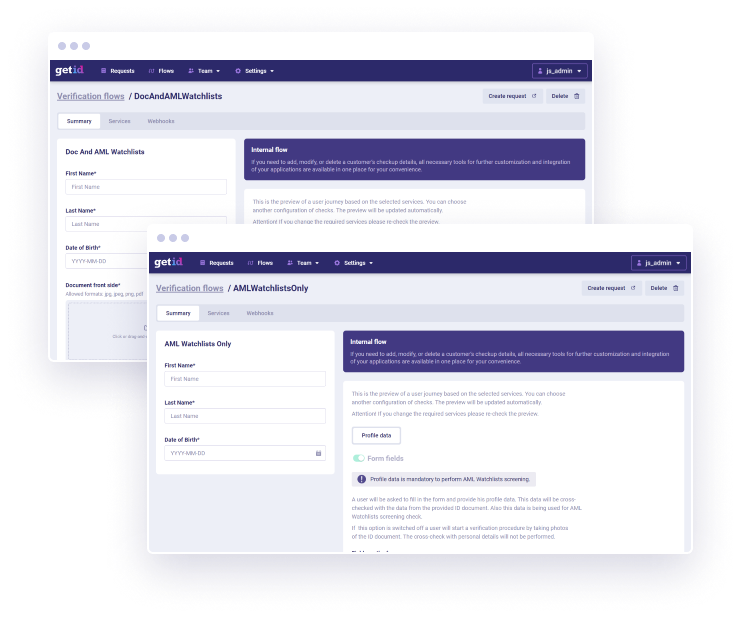

Internal Flow — a handy tool for Compliance Teams

Use our KYC software if you already have customer data (ID documents) that need to be verified according to regulatory requirements.

KYC Flow Builder allows compliance teams to easily set up an Internal Flow. This feature is useful in case your company is collecting customer data from multiple sources. It’s also convenient for rechecking unsuccessful verification results. Customer data and documents can be uploaded directly to the Administration portal and re-verified.

- Reduce the time for document verification

- Automate the manual data entry process

- Trust verification to artificial intelligence trained on multiple models

- Track results in real time

Set up a flow of client ID document verification for compliance officers also step-by-step with a selection of services. Note that the Internal flow only supports the ID document verification and AMl Screening.

A detailed report will be generated for each client with all the data the system determines. This is especially important if you will use AML watch lists.

While even more important we have been able to open up new countries as a result of our ability to successfully verify clients from countries where previously we…