AML Screening Software That Works for Your Business

Threats of Money laundering requires businesses worldwide to take protection measures. Effective AML screening is critical across industries that deals with any kind of financial transactions. Our AML screening software keeps you protected while making compliance easier for your business.

Our advanced AML monitoring solution combines cutting-edge technology with large global databases to deliver accurate and real-time screening results. We help you identify high-risk individuals and entities before they impact your business but at the same time maintaining smooth customer onboarding.

Complete AML Screening Solution with Real-Time Monitoring

The GetID AML screening software gives you quick results while staying very accurate. Our system automatically checks your customers against global watchlists and keeps checking for any changes. This helps you follow the rules and regulations.

The system works smoothly with your current verification process, creating a simple workflow. Our clients find that 95% of initial screenings are accurate with fewer false alarms than most other systems.

✓ Quick AML check results

✓ Daily checks for status changes

✓ Automatic alerts for suspicious activity

✓ Works well with KYC verification

✓ Full record-keeping for staying compliant

Document Verification Software

Verify and authenticate ID documents at scale in real time.

Liveness Detection System

Add another level of security to prevent fraud. Liveness Detection ensures that the users are “live” by asking them to complete a task on camera (smiling, blinking or turning their head).

KYC and Onboarding automation

Save time and money by automating the KYC/Identity Verification process.

Face Recognition Technology

Verify a customer’s identity by comparing an ID document photo with a selfie-picture to make sure that they (both) belong to the same person.

Database With Global Coverage

Our AML screening software connects to a network of global databases to make sure nothing is missed. The system will check sanctions lists, PEP databases and news sources from around the world. All data is updated on a daily basis to make sure you always have the latest information.

Global Coverage

Global Coverage: 190+ countries included

Compliance with regulatory requirements

Fully compliant with most regulations

AML Screening

Millions of news articles with daily updates

Process automation

Daily updates for all databases

How Our AML Screening Software Works

The AML screening process uses automations and smart analysis to give you accurate results quickly. The system uses what we call “advanced matching” to find potential risks.

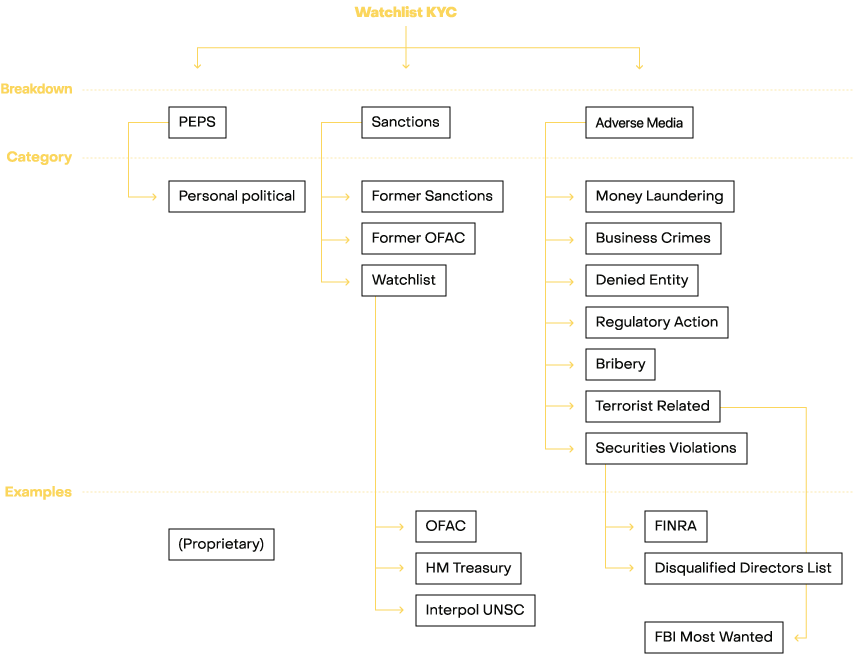

Sanctions Lists

800+ global lists (OFAC, HMT, FINRA, Interpol)

PEPs (Politically Exposed Persons)

PEPs Screening: 1.6 million detailed PEP profiles.

Adverse Media

Get more information about your clients for better risk assessment and management. Billions of screened media articles with constantly updated data.

First Check: Your customer’s data is checked against all important databases

Risk Score: The system automatically scores the risk based on what is found

Ongoing Checks: The system keeps checking for any changes in status

Quick Alerts: You get instant notifications for any new matches

Tools: Simple tools for reviewing and solving alerts

Our AML check process is built to be fast without missing anything important. The system flags potential issues for review while letting low-risk customers move forward without delays.

AML Compliance Benefits Your Business

Using GetID’s AML screening software gives you immediate compliance benefits and at the same time you are reducing costs. Our automated approach removes the need for manual reviews in most cases, letting your team focus on other things.

The system reporting tools make regulatory audits fairly simple. You can create reports whenever you need them to show regulators your compliance efforts.

Some of the Benefits are of course:

✓ Following Regulations: Stay in line with global AML rules (FATF, FINMA, FCA, CySEC, MAS, FSA).

✓ Working Faster: Cut manual review time by up to 80%.

✓ Reducing Risk: Find high-risk clients before they cause problems.

✓ Saving Money: Lower compliance costs through automation.

✓ Protecting Your Name: Protect your business from fines and reputation damage.

Flexible AML Check Integration Options

There are several options to add our system to your existing platform. Our API lets you connect to your existing systems while our web SDK helps you set it up quickly with minimal development work.

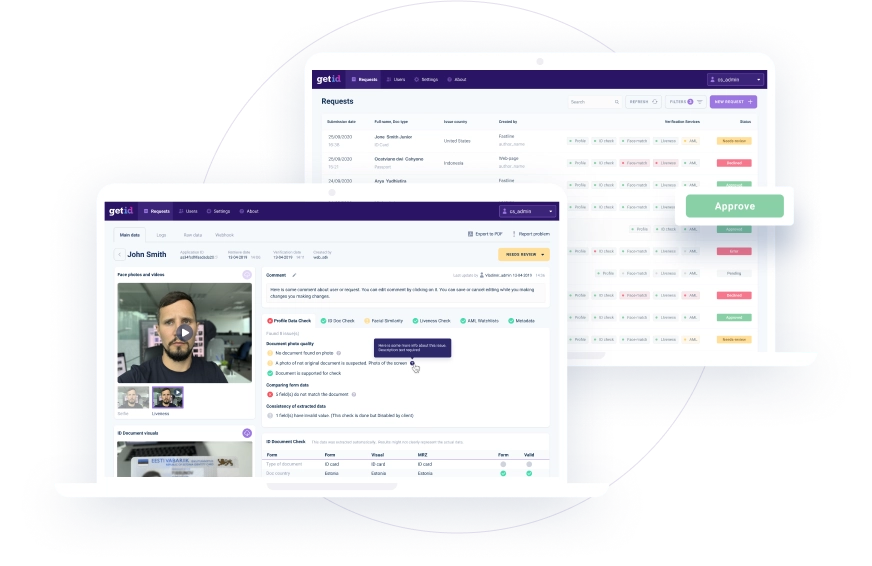

The admin portal gives you a user-friendly way to handle screening results and case workflows. You can customize the screening process to match your risk level and compliance requirements.

API Connection

Easy to add to your existing systems.

Web SDK

Quick setup with minimal development needed.

Admin Portal

Cloud-based software that shows all screening results.

Custom Workflows

Adjust the screening process to fit your needs.

Industries That Benefit from Our AML Screening Software

While AML compliance is important for all industries, each one of course has different challenges. GetID’s AML screening solution adapts to these specific needs.

Some of the industries that benefits from our AML Screening solutions are:

✓ Banking and Financial Services: Follow strict regulations while keeping customer onboarding smooth.

✓ Cryptocurrency and Fintech: Meet compliance and reducing fraud.

✓ Payment Providers: Stop money laundering while processing transactions quickly.

✓ Gaming and Gambling: Follow regulations and protect against under age usage.

✓ Real Estate: Check clients and deals for possible money laundering activities.

AML Monitoring That Keeps Up With Changing Rules

Rules and regulations change often with new requirements being added regularly. Our AML monitoring system automatically adapts to these changes, keeping your compliance program up to date without manual updates.

Our ongoing monitoring does more than just initial screening, it keeps checking customer status against updated watchlists. This active approach finds risks as they appear, not just during the sign-up process.

✓ Rule Updates: Automatic adjustments to changes in compliance requirements.

✓ Adjustable Risk Levels: Set screening parameters based on your risk comfort.

✓ Complete Reporting: Create reports that is needed by auditors and regulators.

✓ Full Records: Complete history of all screening activities and results.

✓ Case Management: Tools for investigating and documenting potential matches.

The AML Check Process - Easy for Users, Thorough for Compliance

The AML check process is designed to be simple for “good customers” and at the same time maintaining strong compliance standards. Users will just provide their basic information during sign-up and our system handles the screening in the background.

For higher-risk customers extra verification steps can be triggered automatically based on risk factors. This approach ensures proper checking while keeping the customer experience as smooth as possible.

Advanced AML Screening Technology Working Behind the Scenes

Our AML screening software uses smart technology to match customer data against global watchlists. The system accounts for name variations, different spellings and common typos to ensure thorough screening without too many false alarms.

Machine learning helps to improve the matching accuracy based on feedback from reviews. This adaptive approach makes the system better over time and reduces the need for manual reviews.

Ready to Strengthen Your AML Compliance?

Take the next step toward better AML protection with GetID’s advanced screening solution. Our team can show you how the platform works and discuss your specific needs.

Start with a free trial to see the difference in accuracy, efficiency and coverage compared to your current solution.

Get Started With Our AML Software Today

FAQ

What is AML screening and why is it necessary?

AML screening is when you check individuals or companies against sanctions lists, PEP databases and news sources in order to find potential money laundering risks. This type of screening is necessary to follow regulations and protect your business from financial crimes. Most countries legally require some kind of AML check for financial services and other regulated industries.

How often should AML screening be performed?

You should always do AML screening when a customer first signs up. Ongoing monitoring is also important to pick up on changes in customer risk status. Best practice is to check your customer base daily against updated watchlists. GetID’s AML screening software does this automatically to make sure you stay compliant.

What databases does GetID's software check?

Our AML screening software checks over 800 global sanctions lists including OFAC, UN, EU, HMT, and FINRA. It also screens against 1.6 million PEP profiles and billions of news articles. The coverage includes 190+ countries and is updated daily for complete protection.

How does GetID handle false positives?

Our system uses smart matching technology and machine learning to reduce false positives while still catching real risks. When potential matches are found they get confidence scores to help prioritize review. The case management system helps compliance teams efficiently investigate and document decisions.