Used by

- Brokerage companies

- Investment funds

- Crowdfunding

- Investment Marketplaces

Expand your company’s geographic coverage to more than 190 countries, while remaining compliant with local and global regulations. Attract more trade-ready customers, reduce onboarding time through fast customer identification.

Onboarding speed-up

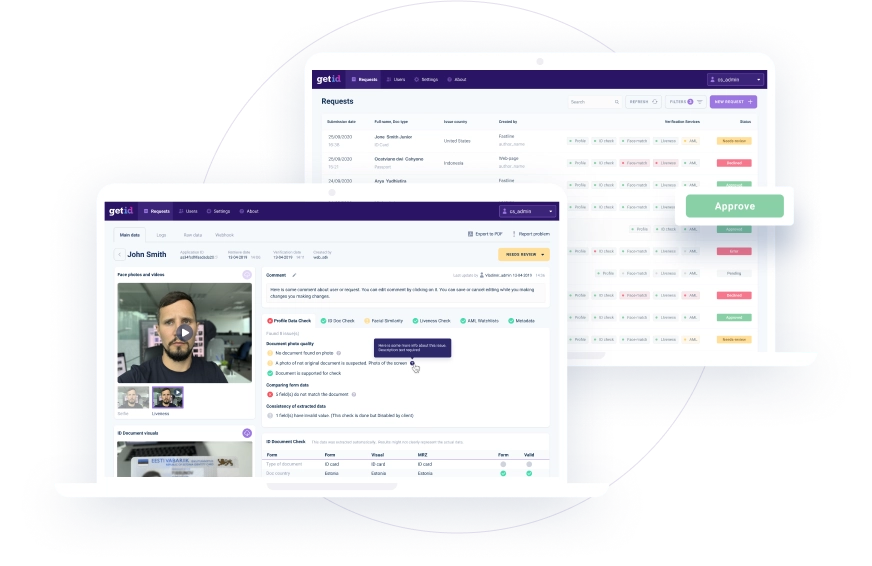

Reduce customer verification time to a few seconds by automating the KYC process. Minimise manual verification, relieve the compliance team of routine tasks.

Ready to scale and stay compliant

Stay compliant with global regulators (FATF, FINMA, FCA, CySEC, MAS, FSA) by easily connecting to different regions of the world. We process 900+ document types from 190+ countries.

Reduce the cost

The cost of verifying customers can be reduced several times over by automating the process. Artificial intelligence handles thousands of requests a day, while a human handles no more than a hundred.

Any questions? Talk to our expert

Why Trading Platforms Typically Choose GetID

Faster Trader Onboarding

Verify traders in under 60 seconds with automated document checks and biometric verification. This helps you reduce drop-off rates during account opening and get your users trading faster. Our streamlined process eliminates lengthy manual reviews that frustrate potential customers and hurt conversion rates.

Global Regulatory Compliance

Make sure you are always compliant with trading regulations across all markets including FCA, CySEC, FINMA and MiFID II requirements. Our platform automatically adapts to different jurisdictions so you can expand globally without worrying about local compliance rules. We handle the complexity while you focus on growing your business.

Advanced Fraud Prevention

Protect your platform from synthetic identities, document forgeries and account takeovers with our AI-powered fraud detection. Advanced algorithms analyze multiple data points to identify suspicious behavior before fraudsters can harm your platform. This protects both your own business as well as legitimate traders.

Scalable Verification Solutions

With our KYC solution for trading you can handle thousands of verification requests daily. Basically our automated platform scales with your business. Whether you’re processing 100 or 100,000 verifications per month, our infrastructure maintains fast response times and high accuracy rates without requiring additional manual resources.

Customized Verification Solutions for Different Trading Models

Forex and CFD Brokers

Meet strict forex regulations with enhanced due diligence and ongoing monitoring. Verify trader identities, assess risk levels and screen against global sanctions lists on a daily basis. Our solution supports the sometimes complex compliance requirements that forex brokers face in regulated markets worldwide.

Investment Platforms

Streamline investor onboarding with “suitability assessments” and “accredited investor verification”. Support different investment tiers with customizable verification flows based on for example investment amounts and risk profiles. We ensure that you are compliant with investment regulations and that you are maintaining a smooth user experience.

Cryptocurrency Trading

Navigate evolving crypto regulations with Travel Rule compliance and enhanced AML screening. Link verified identities to wallet addresses when required and monitor suspicious transaction patterns. Stay ahead of changing crypto compliance requirements across different jurisdictions.

Wealth Management Companies

Automate client onboarding for digital wealth management with risk profiling and suitability checks. Verify client identities quickly while gathering necessary information for investment advice algorithms. Support both retail and high-net-worth client verification workflows.

Ready to Improve Your Trading Verification?

GetID’s verification platform is ready to scale with your trading business. Our implementation team works with your developers to ensure smooth integration with comprehensive documentation and sandbox environments. Contact our sales team to discuss your specific requirements.

FAQ

What is KYC for trading companies?

KYC (Know Your Customer) for trading companies involves verifying trader identities, assessing risk levels and ensuring compliance with financial regulations to prevent fraud and money laundering.

How does GetID help with regulatory compliance?

GetID is a KYC software that automatically adapts to different jurisdictions requirements, provides AML screening against global databases and maintains detailed audit trails for regulatory reporting and compliance audits.

How fast can traders be verified?

Most traders can be verified in under 60 seconds using automated document checks and biometric verification. However though complex cases may require additional review.

Which documents are required for trading verification?

- Typically a government-issued photo ID like passport or driver’s license.

- A proof of address such as utility bills or bank statements, depending on regulatory requirements.

Are you ready to get started?

Interested in knowing more about Identity Veriification?

Read our related articles prepared by proven experts in the field

What is Mobile Identity Verification?

In today’s digital era, smartphones have become an indispensable part of our lives. With their widespread use, mobile identity verification has gained popularity as a convenient and secure way to remotely confirm identities. In this article, we will explore the concept of mobile identity verification, its benefits, and its implications

Enhancing Financial Inclusion: Identity Verification for the Underbanked

In an increasingly digital world, identity verification is a fundamental requirement for accessing various services and participating in the global economy. However, a significant portion of the population known as the underbanked faces unique challenges in verifying their identities due to limited access to traditional financial services. This article explores

Blockchain-based Identity Verification: Enhancing Security and Trust

In today’s digital landscape, ensuring secure and trustworthy identity verification is crucial. Blockchain technology has emerged as a game-changer, offering decentralized and tamper-resistant solutions for identity verification. This article delves into the potential of blockchain-based identity verification systems, their advantages, real-world applications, and the challenges they face. Let’s explore the