Why Crypto Companies Choose GetID for user Verification

In the Crypto industry businesses needs identity verification that balances speed with compliance. Traditional KYC solutions often don’t understand the unique challenges that crypto companies faces. Our KYC software can be specifically adjusted to handle these needs.

Fast user onboarding is critical in the crypto space and is a competitor advantage. Users expect access to trading and services quickly, but you still need thorough verification. GetID verifies users in under 60 seconds, reducing drop-off rates as well as maintaining high security standards.

Regulatory compliance in crypto is complex and constantly changing. One of the key benefits with platform is that it automatically adapts to different jurisdictions and regulatory requirements. Whether you’re dealing with Travel Rule compliance or local AML requirements we handle the complexity so you can focus on growing your business.

Global reach is also important for crypto businesses. GetID supports documents for verification from over 190 countries, this helps you onboard users from all over the world. Our system recognizes government-issued IDs, passports and other documents that crypto users normally use for their verification.

Cost efficiency is another important part when you want to scale a crypto platform. Manual verifications are expensive and takes a long time to carry out. GetID automates most of the KYC process which reduces your operational costs and improves user experience.

Used by

- Crypto Wallets

- Crypto Funds

- P2P exchanges

- Custodial wallets

- Crypto ATMs

- DAaps

- Mixers

- Crypto payment-processors

- DEX’s*

- ICOs**

- Mining pools***

KYC Verification for Different Types Of Crypto Business

Different crypto businesses have different verification needs and our flexible platform adapts to what you need.

GetID does not only verify government-issued IDs, we also perform biometric checks and screens against global AML watchlists. This helps exchanges meet regulatory requirements while at the same time keeping users happy with quick verification.

Crypto wallets

Crypto wallets often need tiered verification based on transaction limits. Our system can be set up to verify basic information for small transactions and require additional checks for higher limits. This approach balances user experience with regulatory compliance and reduction of fraud.

DeFi platforms

DeFi platforms face unique challenges with decentralized finance regulations. GetID provides identity verification that works with DeFi protocols while meeting these specific compliances. We can help the linking of verified identities to wallet addresses when needed.

NFT marketplaces

NFT marketplaces often need to verify both creators and buyers. Our verification system handles artist verification for minting and buyer verification for higher level of purchases. This builds trust in your marketplace while preventing fraud.

Crypto payment processors

Crypto payment processors require both merchant and user verification. GetID's business verification features handle company documents while our standard KYC covers individual users. This comprehensive approach covers all your verification needs.

Easy Integration for Crypto Platforms

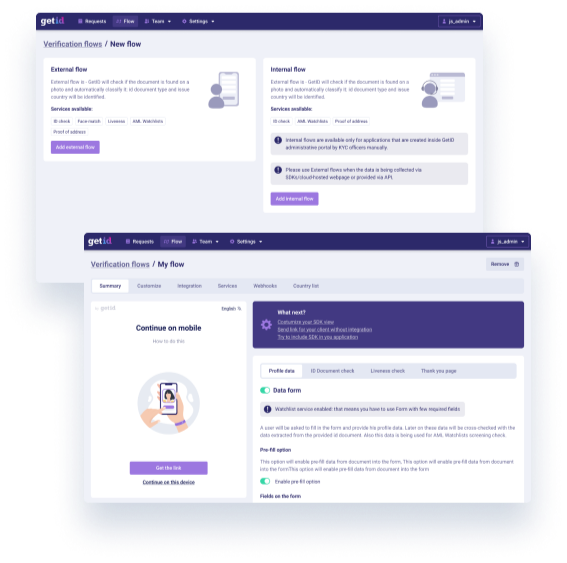

GetID integrates seamlessly with your existing technical infrastructure. Our API-first approach means that you can expect to be up and running with us quickly without major development work on your end.

Choose from multiple integration options based on your platform needs. Our RESTful API provides complete control over the verification flow. Mobile SDKs for iOS and Android offer native app experiences for crypto wallet apps. Web SDK enables quick browser-based implementation for exchanges and trading platforms.

The custom workflow builder lets you create different verification paths for different type of users. High-risk users or large transaction amounts might need additional checks while low-risk users can be verified instantly. You can set the rules and thresholds based on your risk tolerance.

Real-time webhooks keep your systems updated throughout the entire process. Get instant notifications when a verification completes, fails or requires a manual review. This ensures your users gets immediate access when verified but still maintaining security protocols.

Stay Compliant with Regulations

Regulatory compliance is definitely one of the biggest challenges crypto companies faces. With the GetID platform it becomes much easier to handle. Automated screening and comprehensive reporting helps you stay on top of all the compliance issues.

Our AML screening covers over 800 global sanctions lists, PEP databases and adverse media sources. Daily updates ensures that you’re always screening against the latest information available. This is particularly important for businesses that face enhanced scrutiny from regulators and the crypto industry is one of them

“Travel Rule” compliance is also becoming critical for crypto businesses. GetID helps you identify VASP-to-VASP transactions and maintains the required records for you. Our system can flag transactions that require additional information sharing between different crypto service providers.

Data protection is built into our platform architecture. All customer data is of course encrypted and stored securely. We offer data residency options to meet local requirements and provide detailed audit trails for regulatory reporting if needed.

Our reporting tools generate the documentation you need for compliance audits. Export verification results, risk assessments and screening reports in formats that crypto regulators expect.

Admirals is the leading provider of financial solutions for the European securities market. The company serves over 30 thousand people a month from more than 130 countries.

The company has introduced automatic customer identity verification and the results have been impressive.

While even more important we have been able to open up new countries as a result of our ability to successfully verify clients from countries where previously we did not have such an option.

Head of Global Compliance at Admirals

Сompany has implemented automatic customer identity verification and as a result:

reduction in customer verification time

increase in customer conversion rates

Advanced Features for Crypto Verification

GetID’s features can be designed specifically for the unique needs of crypto businesses.

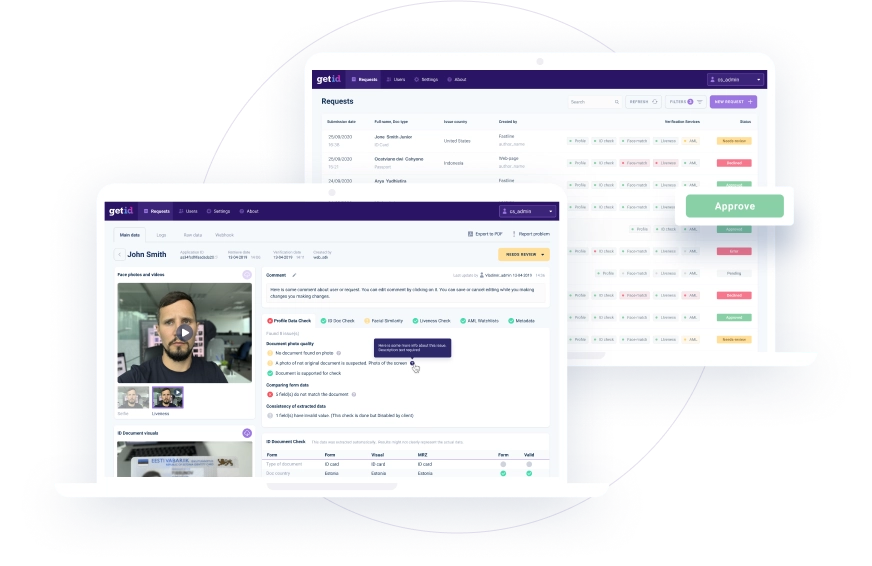

Our AI-powered system extracts data accurately while detecting possible tampering and forgeries. This covers everything from passports and driver’s licenses to utility bills and bank statements that crypto users typically provides.

Biometric verification includes liveness detection and face matching to prevent spoofing attacks. Users simply take a selfie that’s compared against their ID photo. This prevents account takeovers and ensures the person opening the account is who they claim to be.

Risk scoring provides AI-powered assessment of each verification attempt. Multiple data points are analyzed to generate risk scores that help you make informed decisions about user acceptance. This is particularly valuable for crypto businesses that need to assess money laundering risks.

The monitoring doesn’t stop after initial verification. Daily screening against updated watchlists helps detect if existing users become potential high-risk. This ongoing approach is important for businesses that face enhanced monitoring requirements.

Transaction monitoring capabilities can link identities to blockchain addresses when needed. This helps with compliance reporting and suspicious activity detection.

Ready to Improve Your Crypto Verification?

The GetID verification platform is ready to scale with your crypto business. Whether you’re launching a new exchange or adding verification to your existing platform we have the tools and expertise to help.

Our implementation team works closely with your developers to ensure a smooth integration. Comprehensive documentation, SDKs and sandbox environments make testing and deployment straightforward for all type of crypto platforms.

Contact our sales team to discuss your specific requirements and see how GetID can improve your verification process. We understand the unique challenges crypto businesses face and can customize our solution to your business.

Are you ready to get started?

Interested in the best practices for AML and KYC Compliance?

Read our related articles prepared by proven experts in the field

What is Mobile Identity Verification?

In today’s digital era, smartphones have become an indispensable part of our lives. With their widespread use, mobile identity verification has gained popularity as a convenient and secure way to remotely confirm identities. In this article, we will explore the concept of mobile identity verification, its benefits, and its implications

Enhancing Financial Inclusion: Identity Verification for the Underbanked

In an increasingly digital world, identity verification is a fundamental requirement for accessing various services and participating in the global economy. However, a significant portion of the population known as the underbanked faces unique challenges in verifying their identities due to limited access to traditional financial services. This article explores

Blockchain-based Identity Verification: Enhancing Security and Trust

In today’s digital landscape, ensuring secure and trustworthy identity verification is crucial. Blockchain technology has emerged as a game-changer, offering decentralized and tamper-resistant solutions for identity verification. This article delves into the potential of blockchain-based identity verification systems, their advantages, real-world applications, and the challenges they face. Let’s explore the