Increase your Customer Onboarding Experience with our Platform

The customer onboarding process is often a critical key for your business. Having a smooth onboarding for your customers but at the same time keeping fraud away is always a challenge. GetID’s customer onboarding platform transforms this crucial touchpoint into a competitive advantage.

Our comprehensive onboarding software streamlines the verification process and at the same time maintaining security and compliance. With customizable workflows and intuitive design we help businesses reduce abandonment rates by up to 40%. We increase “time-to-value” for new customers.

- verify clients identities in a matter of moments

- reduce manual error risk while using human power

- increase onboarding rates

- effectively prevent fraud

- stay compliant with AML KYC regulations

How Our Verification for Customer Onboarding Work

The GetID onboarding platform has a user-centric approach for verification. We ensure minimal friction while maintaining robust security. Customers begin by selecting their preferred verification method: mobile, web, or in-app. They are then guided through a simple intuitive process with clear instructions on each step.

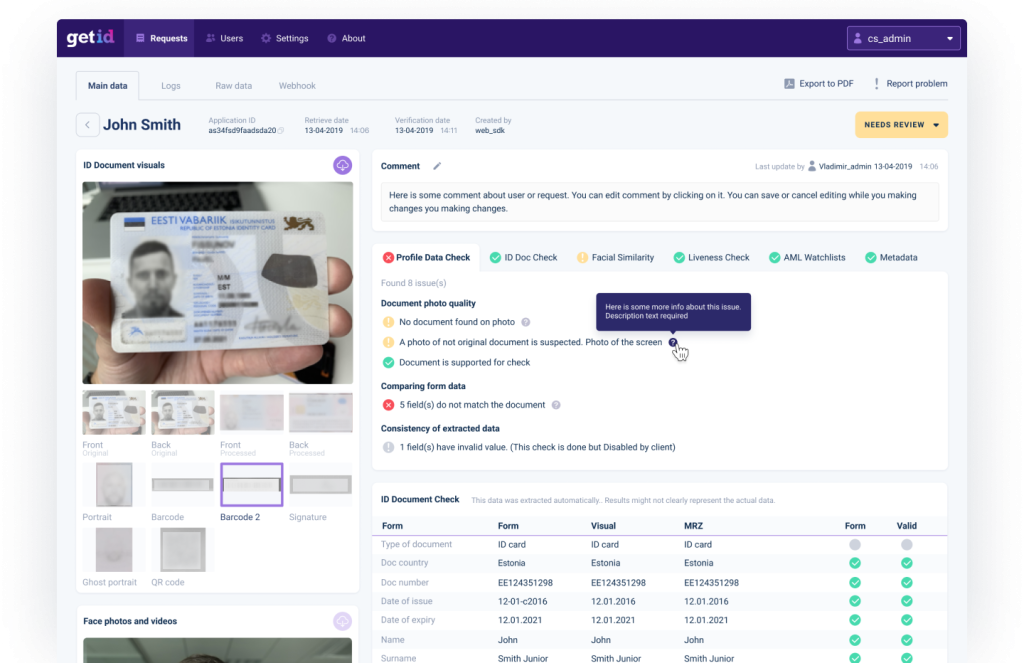

Our document processing technology automatically recognizes over 14,000 ID types from over 200 countries and it extracts relevant data in seconds. The system performs multiple authenticity checks simultaneously. It verifies security features, data consistency and document validity without extending the time a customer has to wait.

For enhanced security our biometric verification compares the customer’s selfie with their ID photo using advanced facial recognition algorithms. The optional liveness detection feature also prevents spoofing attempts. It requires simple movements that confirm the user is physically there.

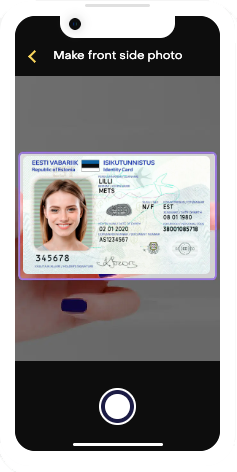

Step 1

User photographs their ID from both sides.

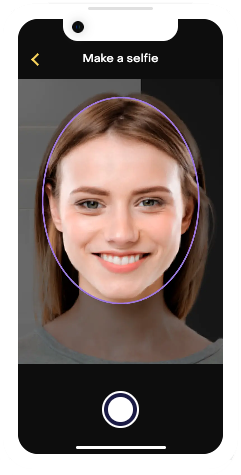

Step 2

User takes a self-portrait with their smartphone camera or webcam.

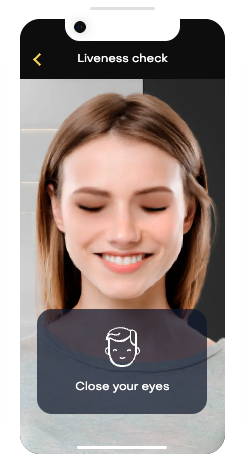

Step 3

User performs some simple movements for liveness detection purposes.

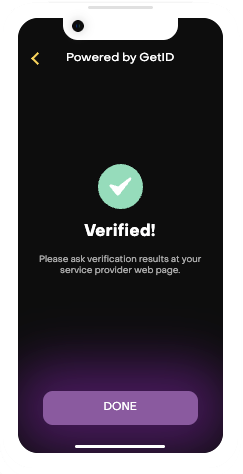

Done!

User is verified, onboarded and ready to go.

Client Onboarding and KYC Process - completely personalized

With GetID you can easily adjust the workflow – add or remove identity verification steps depending on your current onboarding requirements.

ID Document Verification

Over 7000+ supported document types supported from 223+ countries and territories.

Face Matching

Verify a customer’s identity by comparing an ID document photo with a selfie-picture to make sure that they (both) belong to the same person.

Liveness Detection

Add another level of security to prevent fraud. Liveness Detection ensures that the users are “live” by asking them to complete a task on camera (smiling, blinking or turning their head).

AML Screening

High-risk clients monitoring for customer due diligence. PEPs and Sanction Lists, Adverse Media checks. Over 800 global lists and 1.6 million profiles.

Where Instant Verification is Needed for Customer Onboarding

One could say that any online business that would like to reduce fraud has a need for the GetID Onboarding software. There is however more than just the fraud reduction side to take into calculation. For example there are industries such as finance and gaming where regulatory compliance is a key to even stay in business.

E-commerce and subscription businesses mostly implement our onboarding software to reduce payment fraud. They can also verify age-restricted purchases and streamline premium service enrollment.

Here are some examples of industries that benefits from our customer onboarding software:

Age-restricted Products

Bank account opening

Sharing Economy services

Crypto Wallets and Exchanges

Benefits of Using a Proper Onboarding Software

Implementing GetID as an onboarding platform delivers measurable business impact. Our clients report an average of 35% reduction in abandonment rates during the onboarding process compared to earlier. This of course results in higher conversion rates and improved customer acquisition costs.

The automation capabilities eliminate manual review requirements with up to 95% of straightforward cases. Your team can instead focus on exceptions that require human judgment. This efficiency reduces onboarding time from days to minutes. It decreases operational costs by up to 60% compared to traditional verification methods.

Our platform’s responsive design ensures consistent experiences across all devices. We maintain a 99.8% uptime reliability and load times under 3 seconds even during peak traffic hours. The intuitive interface requires no technical knowledge from end users. This results in higher completion rates and positive first impressions of your brand.

Speed and instant results

- Fast and accurate verification results

- Speed up the account opening time

- Maximize customer onboarding success rates

AML KYC Compliance

- Stay compliant with global regulatory requirements

- AML Screening for Customer Due Diligence

- Better risk management

Flexible Onboarding solution

- Mobile and web SDKs

- Omni-Channel platform

- API´s

Reduce operational costs

- Automate the onboarding process

- Reduce manual workload

Staying Compliant with Regulations

Making sure you are compliant with regulations is extremely important and requirements changes on a regular basis. Our onboarding software includes an adaptive compliance framework that automatically updates to reflect changes in regulations for your operating regions.

Configuration options allow you to implement different verification levels based on risk profiles, transaction values or customer segments. This risk-based approach is very good for regulatory requirements.

Every verification action is documented in an audit trail with tamper-proof timestamps and we keep detailed records of each step in the process. These records can be exported in multiple formats for regulatory inspections or internal compliance reviews. This shows regulators your commitment to proper verification procedures.

Reducing Fraud is a Cost Saver

Fraud prevention represents a significant return on investment for using a quality onboarding software. Our platform’s advanced detection capabilities identify sophisticated fraud attempts. These include forged documents, synthetic identities and account duplication schemes that might otherwise go undetected.

The multi-layered verification approach combines document authentication, biometric matching and behavioral analysis. This creates a robust security framework. Our clients report as much as a 75% reduction in fraud-related losses after implementation. Some financial services customers can save millions annually.

Beyond direct fraud losses the platform reduces costs associated with manual reviews, compliance penalties and of course reputation damage. The customizable risk scoring system allows you to set thresholds appropriate for your business model and risk tolerance. It automatically flags suspicious applications for additional checks.

Easy to Use and Rapid Integration with Your Existing Setup

Implementing our customer onboarding platform requires minimal technical resources. Most clients actually complete the integration within 1-2 weeks with help from our onboarding team. We provide comprehensive SDKs for both web and mobile platforms and Webhook notifications deliver real-time status updates to your existing systems.

The white-label customization options ensure the verification process matches your brand identity. You can adjust colors, logos, fonts and messaging and our multi-language support covers 40+ languages with automatic detection based on user settings. This ensures accessibility for customers on a global scale.

Our platform seamlessly connects with popular CRM systems, user management tools and payment processors through pre-built integrations. Everything is easy to customize and allows you to implement only the components you actually need. You of course have the flexibility to add features as your needs changes in the future.

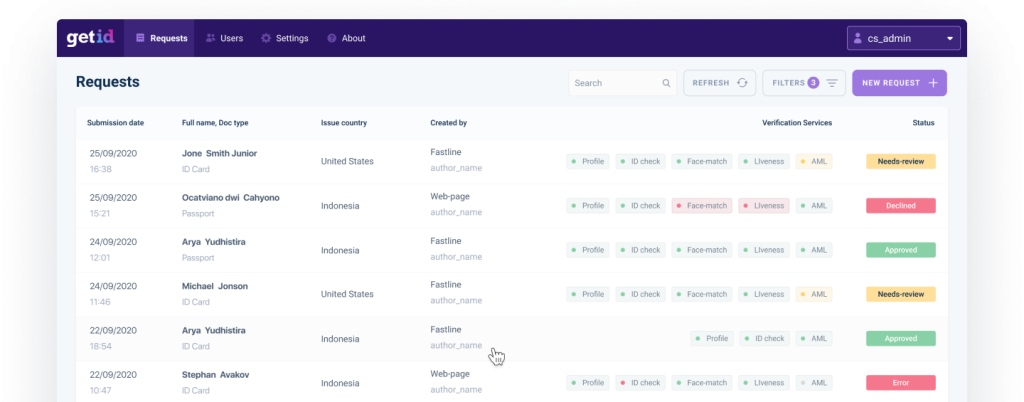

- Verification results and status overview

- Real-time monitoring

- GDPR-compliant customer data storage

Invest In Better Customer Onboarding Today

Ready to take the next step to increase your customer onboarding experience? Our team is available to provide a personalized demonstration of the platform. Start with a free trial to experience the difference in conversion rates, operational efficient and customer satisfaction.

Contact our onboarding specialists at onboarding@getid.com or schedule a demo through our website. Join the hundreds of businesses already using GetID’s customer onboarding platform to create seamless secure verification experiences. Convert more customers while reducing costs and fraud risks.

Are you ready to get started?

FAQ

How does customer onboarding help reduce fraud?

Our platform combines document authentication, biometric matching and behavioral analysis to verify identities. The system checks security features and document validity simultaneously.

Suspicious applications are automatically flagged based on your risk settings

Which businesses can benefit from KYC screening?

Our onboarding software serves multiple business needs across industries. While financial services often implement it for regulatory compliance and gaming platforms for age verification, the most common application is fraud prevention. Any business looking to reduce fraud-related costs while maintaining a smooth customer experience will benefit from our platform.

How does onboarding softwares help with regulatory compliance?

Our software stays up to date with changing regulations automatically. You can choose different levels of verification depending on what your business needs. The system keeps records of all verification steps with secure timestamps. When regulators ask for proof of compliance, you can easily show them these records. This helps you meet requirements without creating extra work for your team.

How long does a customer onboarding typically take?

The process takes less than a minute for end users. Our technology recognizes 14,000+ ID types and extracts data in seconds. Businesses typically complete integration within 1-2 weeks with our team’s help. The system provides instant verification while maintaining high security standards.