Complete KYC Solution for Fintech

Streamline customer onboarding, reduce fraud and most importantly stay compliant with our identity verification platform for fintech. GetID helps fintech companies verify users in seconds and at the same time meeting regulatory requirements in your markets.

Used by

- Online banks

- Wallets

- Crowdfunding platforms

- P2P lending services

GetID provides a modern and cost-efficient KYC and onboarding platform for Fintech companies.

Everything you need for user verification and compliance available in one solution. Find out how GetID can help your business today.

Why Fintech Companies Choose GetID for Identity Verification

Fintech companies face unique KYC-challenges that traditional verification solutions often can’t handle. Our fintech solution for fintech addresses these specific needs with speed, accuracy and global coverage.

Fast customer onboarding is critical for success in the fintech industry. GetID verifies customer identities in under 60 seconds, reducing drop-off rates during the sign-up face. Our automated document verification and biometric checks eliminate long manual reviews that can frustrate users and in the end also hurt conversion rates.

Regulatory compliance doesn’t have to slow you down. Our “KYC for fintech” solution automatically adapts to different jurisdictions to ensure that you meet local requirements. It doesn’t not matter if you’re operating in Europe, Asia or America. We handle the complexity so you can focus on growing your business.

Fraud prevention is built into every step of our process. Advanced AI algorithms detect synthetic identities, document tampering and suspicious behavior before fraudsters can exploit your platform. This protects both your business and your actual customers.

KYC for Fintech Across All Business Models

Each fintech business model have it´s unique verification needs. Our flexible platform can adapt to your specific requirements.

Digital banks and neobanks

often need fast account opening without compromising security. GetID verifies government-issued IDs from over 190 countries, performs liveness checks and screens against global AML watchlists - all in one seamless flow

Payment processors

on the other side require both merchant verification and user onboarding capabilities. Our KYB (Know Your Business) features can verify company documents and beneficial ownership while our standard KYC handles individual users.

Cryptocurrency exchanges

are facing enhanced due diligence requirements. GetID provides comprehensive AML screening, regular monitoring and detailed audit trails to meet the stricter crypto regulations.

P2P lending platforms

need to verify both borrowers and lenders quickly. Our "risk scoring" helps assess creditworthiness and of course making sure all parties meet your platform's requirements.

Built With Easy Integration And Maximum Flexibility

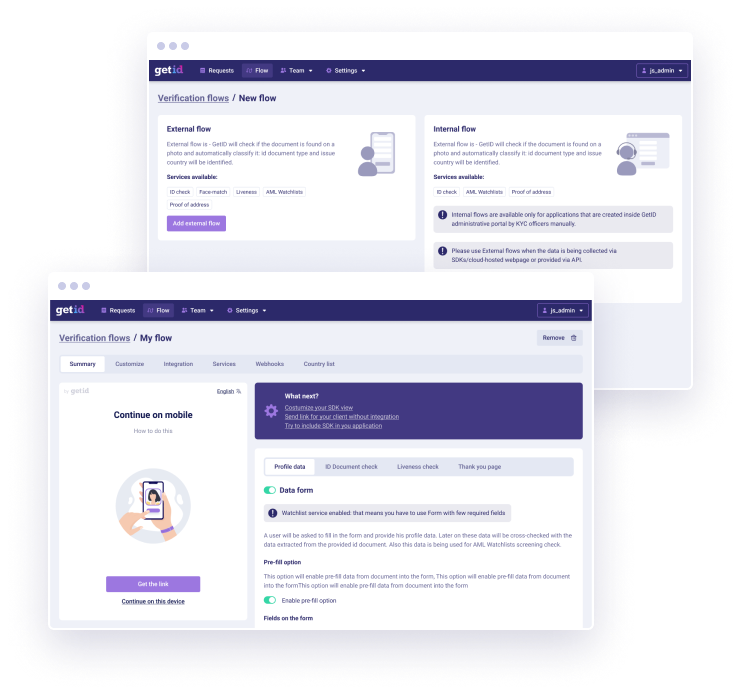

GetID integrates seamlessly with your existing fintech infrastructure. Our API-first approach means you can be up and running in just a few days.

Choose from multiple integration options based on what suits you. Our RESTful API provides complete control over the verification flow.

Mobile SDKs for iOS and Android offers and native app experience. Web SDK enables quick browser-based implementation with minimal development work.

Custom workflow builder lets you create your own verification path for each user segment. High-risk users might need additional checks while low-risk customers can be verified instantly. You control the rules and thresholds.

Real-time webhooks keep your systems updated throughout the verification process. Get instant notifications when verifications complete, fail or require manual review. This ensures your customer experience remains smooth while maintaining strong security.

Stay Compliant in Every Market You Serve

Regulatory compliance is complex within fintech but our platform makes it manageable. We maintain certifications and compliance with major standards including SOC 2, GDPR and PCI DSS.

Our AML screening covers over 800 global sanctions lists, PEP databases and media sources. Daily updates ensures that you’re always screening against the latest information available. Automated monitoring alerts you to any changes in customer risk status even for existing customers.

Data protection is built into our platform and all customer data is encrypted in transit. We offer data residency options if needed to meet local requirements and provide detailed audit trails for regulatory reporting.

Comprehensive reporting tools generate the documentation you need for any type of compliance audits. Export verification results, risk assessments and screening reports in formats that regulators expect at any time.

Advanced Features specifically for Fintech Identity Verification

GetID’s fintech identity verification platform includes specialized features designed for financial services.

Our document verification supports over 14,000 document types from over 190 countries. Our AI-powered OCR extracts data accurately and at the same time detecting tampering, forgeries and expired documents. This covers everything from passports and driver’s licenses to utility bills and bank statements.

Biometric verification includes liveness detection and face recognition to prevent spoofing attacks. Users simply take a selfie that’s compared against their ID photo using advanced facial recognition technology.

Risk scoring provides AI-powered assessment of each verification attempt. Multiple data points are analyzed to generate a risk score that help you make informed decisions about customer acceptance.

The ongoing monitoring doesn’t stop after initial verification. Continuous screening against updated watchlists and behavioral analysis helps detect suspicious activity throughout the customer lifecycle.

Transaction monitoring capabilities track patterns and flag unusual behavior. This helps meet anti-money laundering requirements while protecting against fraud.

Proven Results for Fintech Companies

Fintech companies using GetID see measurable improvements in their verification processes. Customer onboarding times decrease by up to 80% compared to manual processes. Fraud detection rates improve significantly while false positive rates remain low.

Conversion rates increase when customers can complete verification quickly and easily. Our streamlined process reduces abandonment during onboarding, helping you capture more qualified users.

Compliance costs decrease through automation. Manual review requirements drop by over 70% for most clients, freeing up your team to focus on more important things.

Customer satisfaction improves with faster and more reliable verification. Users appreciate being able to access your services immediately rather than waiting days for manual approval.

Ready to Transform Your Fintech Onboarding?

Our KYC solutions for fintech is ready to scale with your business. Whether you’re a startup looking to launch quickly or an established company seeking to improve your verification process, we have the tools and expertise to help.

Our implementation team works closely with your developers to ensure a smooth integration. Comprehensive documentation, SDKs and sandbox environments make testing and deployment straightforward.

Contact our sales team to discuss your specific requirements and see how GetID can improve your fintech identity verification process.

Ready to get started?

Let us know what solution you are looking for. We’ll make sure to provide the best possible offer!

Frequently Asked Questions About Fintech Identity Verification

What makes the fintech identity verification different from other industries?

The fintech industry requires faster processing, stricter compliance and enhanced fraud detection compared to other sectors. Financial services face unique regulatory requirements like AML screening and ongoing monitoring that other industries don’t typically need.

How quickly can GetID verify fintech customers?

Most verifications complete in under 60 seconds. Simple document checks can finish in 30 seconds, while more complex verifications requiring biometric checks and AML screening typically complete within 2 minutes.

Is GetID compliant with fintech regulations globally?

Yes, GetID maintains compliance with major financial regulations including GDPR, PCI DSS, SOC 2 and various AML requirements. We adapt our screening and verification processes to meet local regulatory requirements in different jurisdictions.

Can GetID handle high-volume verification requests?

Our platform is built to scale and can process thousands of verifications simultaneously. We maintain a 99.9% uptime and can handle traffic spikes during marketing campaigns or product launches without performance degradation.

Interested in knowing more about KYC and ID Verification

Read our related articles prepared by proven experts in the field

What is Mobile Identity Verification?

In today’s digital era, smartphones have become an indispensable part of our lives. With their widespread use, mobile identity verification has gained popularity as a convenient and secure way to remotely confirm identities. In this article, we will explore the concept of mobile identity verification, its benefits, and its implications

Enhancing Financial Inclusion: Identity Verification for the Underbanked

In an increasingly digital world, identity verification is a fundamental requirement for accessing various services and participating in the global economy. However, a significant portion of the population known as the underbanked faces unique challenges in verifying their identities due to limited access to traditional financial services. This article explores

Blockchain-based Identity Verification: Enhancing Security and Trust

In today’s digital landscape, ensuring secure and trustworthy identity verification is crucial. Blockchain technology has emerged as a game-changer, offering decentralized and tamper-resistant solutions for identity verification. This article delves into the potential of blockchain-based identity verification systems, their advantages, real-world applications, and the challenges they face. Let’s explore the