AMLD5 and its effect on the Real Estate market

21 Jul 2020

It is a common knowledge that the 5th Anti-Money Laundering Directive is steadily becoming a part of the legislation of every EU member-state. The corresponding law was passed in Estonia on 10 July 2020 and it contains several interesting and important changes that we will cover in a series of articles.

Today we will discuss AML, KYC and the real estate market.

We are used to the fact that client identity verification is a norm in the financial sector. But since the previous Directive, the circle of persons to which such procedures are applicable is much wider than before. For instance, the Money Laundering and Terrorist Financing Prevention Act also obligate real estate brokers to check their client details. Why is this now necessary and which past precedents of real estate involvement in money laundering schemes can we recall?

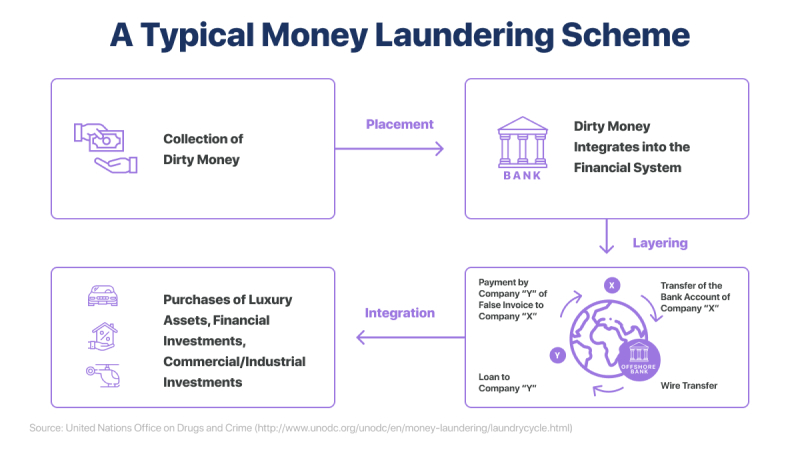

A classic money laundering cycle consists of three stages:

- placement – injection of funds into the financial system via certain methods;

- layering – performance of complex financial operations to conceal the illegal source of the funds;

- integration – usage of the wealth gained from those operations with the illegal funds.

As a rule, real estate transactions are involved in the third stage, as the laundered funds are “invested” into a reliable object allowing to enjoy the criminally gained wealth. It could be a bungalow on a resort in the Caribbean or an apartment in sunny Spain.

Recently this was a prominent issue in Great Britain, where suspicious real estate was discovered amounting to billions of pounds, registered to anonymous offshore companies. The total cadastral value of that real estate as of 1 January 2019 was estimated at between 56 and 100 billion GBP. That forced the local lawmakers to urgently appraise new requirements for inspection of sophisticated sequences of real estate ownership on the British Isles. UK property register “needed urgently” to stop money laundering, including suspicious transactions in the McMafia style, stated Reuters.

One of the most prominent examples of real estate scandals in Great Britain is the case connected with the real estate owned in that country by Gulnara Karimova, the eldest daughter of Islam Karimov, the former President of Uzbekistan. The lawsuits are still ongoing.

In such instances, one can often suspect one of the most common initial crimes – corruption. Plenty of schemes exist for real estate usage in money laundering. For example, a good overview can be found on the AUSTRAC website. Detailed counter-measures have been developed globally. Historically regulators in all countries pay attention to the real estate market, which once again confirms its popularity among criminals seeking to utilise illegal funds.

For example, in 2019 Estonian Financial Intelligence Unit (FIU) has controlled some of the biggest real estate agencies in Estonia and has identified several deficiencies in due diligence measures and in the fulfilment of the obligation to register data. More controls are planned for 2020.

Thus, real estate agencies are facing big risks when dealing with new customers. There’s a lot at stake – agency reputation, non-compliance fines and even possible license revoking.

It is therefore clear why the legislation requires that the professionals and financial institutions engaged in real estate transaction mediation apply client identity verification measures, as well as check sources of the funds when a certain transaction sum threshold is exceeded and suspicions arise.

You can also obtain from us a set of resources for inspection of a party in a transaction. Furthermore, we are ready to help you with customer due diligence process, identification of a transaction party and checking whether the client is on the Politically Exposed Persons (PEP) and Sanctions lists, thus posing a higher than usual corruption risk.

The СOVID-19 situation has stabilised, but it is already clear that the world will never be the same again. More and more transactions are performed online. That tendency includes real estate transactions. Estonia is one of the first countries in the world to have migrated even notarised transactions to the Internet recently.

Inspection of a party in a transaction nowadays is akin to an act of personal hygiene. Whether you want to take a course at Coursera or book an apartment at Airbnb or Booking.com – be prepared to provide an identity document.

Whether working with real estate is your constant primary activity or you just want to be sure your buyer or seller is not a fraudster, understanding that trust does not preclude scrutiny, we will gladly help you find a suitable KYC solution.