KYC and Identity Verification for online Casinos and Gambling services

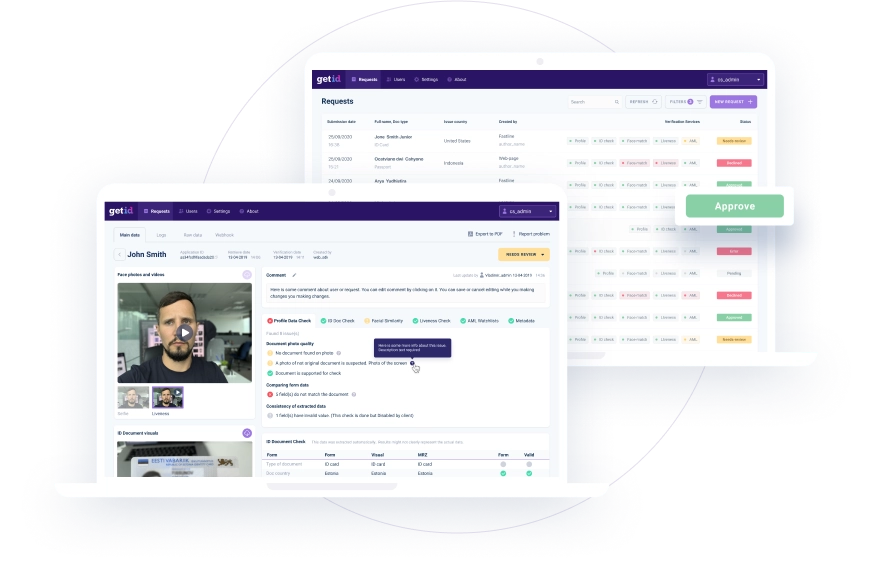

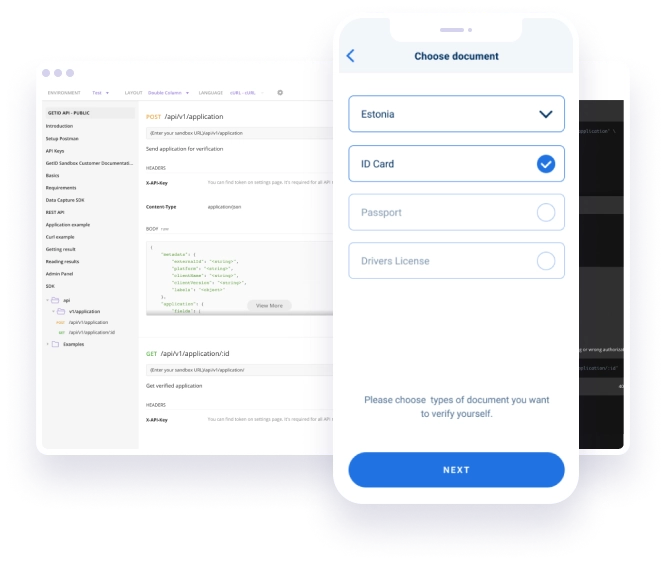

Fast, cost-efficient and secure solution for Identity Verification. Smooth onboarding experience that leads to higher conversion rates. Prevent online fraud and stay compliant with current AML regulations.