Insurance Companies: How to prevent fraud and ensure AML Compliance

1 Jun 2020

Insurance companies, like any other financial institution, are concerned about many specific things that can happen such as money laundering, tax evasion, terrorist financing, and other types of fraud. In order to ensure that they know who their customers are, insurance companies have to identify their customers through KYC procedures. On top of that, insurance companies have to stay compliant with the Anti-Money Laundering regulations for their specific area. An automated solution can provide protection while reducing the time and resources of the company. GetID provides modern and comprehensive omnichannel identity verification services that enable insurance services to stay regulatory compliant, streamline the customer onboarding process and prevent online fraud from happening.

Introduction

Insurance companies are a long-standing part of any community. They provide safety and assurance to those they serve, and just the same, they need assurance of their own. Many have found that using services such as GetID has not only helped them streamline the way they do business, but also protects their assets and their clients, as well.

GetID is helping companies get and stay compliant. This is essential in the ever-changing world of technology, insurance, and regulations. The use of the service also helps to prevent online fraud. Fraud sometimes becomes an issue with companies when their client’s data is stolen, as well as personal and financial data that is sensitive and would otherwise be private.

On top of that, insurance companies have to be able to onboard their customers in a safe and scalable way. Plus, this has to be done while also staying compliant with the regulations set during that time.

As an insurance company, having a company who protects you is vital but one that makes your life easy is important, too. GetID works with insurance companies to not only help them create more trust with their clients, while they work to obtain your trust, but they also make signing up for your clients easier than ever while staying fully compliant. Thus, turning into higher revenues for your insurance company. This increases your reputation while gaining more attention and clients. With the help of GetID, it’s easier to stay regulatory compliant.

The Modern Insurance Industry

The insurance industry today is growing and due to this, many more potential clients are knocking on the doors of companies and brokers who are able to help them. With flexible coverage options, more affordable ways to protect, micro insurance plans, and peer-to-peer insurance offerings; the list of options goes on.

Smartphone apps and quicker, more streamlined, yet protected avenues are going to invite more and more participants to sign up, get in quick with little effort, but become long-term clients.

Overall, describing the insurance company, they offer risk management assurance through the contracts they have with their clients. They guarantee payments for those who sign up and use their services in the case of a loss of some sort, depending on the specific coverage option they have. It is a safe sector for those looking to invest and those looking to protect themselves, their families, and their assets.

As a place that is growing, those professionals working in the industry have found that they are looking to grow with the technological advances and pursue a way to get more clients and become more secure as a company.

As the world advances, those within each industry, especially the insurance one, need to adapt to whatever is coming. This means looking into those resources that might make life easier, efficient, and effective. Through the use of technology in today’s world, it is becoming easier than ever to do.

Why Does Insurance and the Companies Selling it Have to Stay Compliant?

Staying compliant is an ongoing issue that is brought up with many regulated industries around the world. However, those in insurance really need to consider the regulations within the sector.

In order for the insurer to provide the necessary insurance coverage, they have to be compliant with the regulations for not only the insurance field, but also the national and local regulations in the area. This is essential because if an insurance firm is found to not be compliant with these regulations, this could not only mean fines and serious issues, but they may even close down the firm due to not being compliant.

What are the specific regulations?

AMLD5

Known as the EU’s 5th anti-money laundering directive, this regulation has to be adhered by financial organizations. This is an update or addition to the original AML regulation that is already in place.

Coming into effect in July 2018 and has been proposed to be introduced into domestic laws, including those with AML insurance companies. It is followed after AMLD4 and before AMLD6 (which must be implemented by the Member States in their national legislation by no later than 3 December 2020).

Those who are running businesses with money need to adhere to this specific directive, regardless of how they meet the requirements. Those who are found to be failing to follow this directive are facing high amounts of fines.

PSD2

Known as the revised Payment Services Directive 2, it is the second version of the original payment services directive. It is in place to better provide payment regulations for consumers and businesses through technology and other payment methods.

This provides more security regulations and measures for companies or brokers who are initiating or processing electronic payments on a regular basis. This includes not only the client’s financial and personal data, but any other information that is being passed through the technology that the company is being used.

GDPR

GDPR is one of the most important personal data regulations in EU law. It is a regulation that is used to protect data and privacy, as well as transfer or use of this information inside or outside of the EU or EEA areas that the company is working in.

CCPA

CCPA is the California Consumer Privacy Act. It is held up throughout the state of California and intended to be used to enhance the privacy rights of those consumers using services. It provides additional consumer protection for the residents using services in the state.

Those who live in the United States have to be compliant to this specific regulation. Those in the EU or other territories or countries do not have to consider this, though the regulation is good to keep in mind, as it protects the well-being of clients working with any AML insurance institution.

What are the Many Types of Fraud in Insurance?

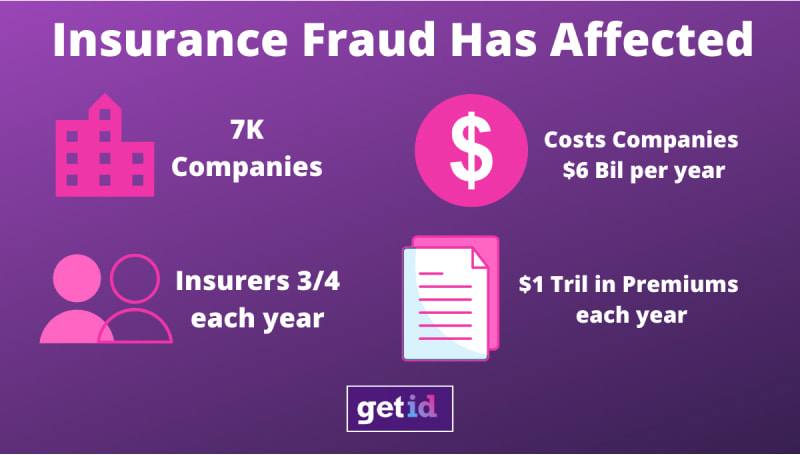

Many people do not realize the amount of fraud that happens in the insurance industry. There is quite a bit that happens, and those who are working in the industry have found that it can be difficult to notice fraud from normal claims.

Thus, while onboarding new customers, insurance companies have to make sure they are partnering with well-intentioned people. This can help to save the company a lot of time and money while ensuring that they are keeping up with compliance on regulations.

Money Laundering

This is one of the biggest issues with insurance companies and passing money through the company. Criminals who want to launder money could easily put the dirty money into the claim that they file with the insurance company, and then receive it back through a check when they cash out on the account.

While the vulnerability of having this happen in the insurance industry is not as high as in the financial industry, it is still one of the biggest issues that insurance companies are faced with.

Fake Accounts

There are a number of fake accounts that can happen with insurance. Not only because these accounts are not in an actual person’s name, but it is usually done through a broker or insurance agent, not just through clients who come to the insurance company.

Skimming – The premiums are stolen through the system before the payments are sent to the account.

Lapping – Premiums for the accounts are stolen and then covered up when they are credited to a fake account in the system that shows the premium of another customer.

Fictitious Policies – These policies are made up, do not actually exist and are paid for through the broker’s own money. These can be held with the insurance firm and are generally not looked into closely because they tend to look and act like a normal, regular insurance policy.

Stolen Identities

Identities within the system can be stolen by anyone who has access to the system. This information is protected, which makes it illegal to steal, but it happens. Those who have access to this information, or get into the accounts of the insurance company, have access to social security information, personal and financial information, and any other information that they may need to steal an identity.

False Insurance Claims

False insurance claims happen every day throughout the entire world. Those who claim that something happens to their loved one, to themselves, or to the property that they have insured, but it does not actually happen can collect on the amount that the insurance company might pay out to cover the costs they promised to pay.

This insurance amount varies depending on the amount of insurance you have on the item. However, many insurance companies are now looking into the claims more closely, as this is something that can cause a series of issues in the end.

Application Fraud

Those who put the information on the application to get the insurance coverage but lie on it are committing fraud. It is important that this information is double-checked when signing up for the claims and coverage, as those who are lying may be getting more coverage than they are supposed to be getting.

How Insurance Companies Can Optimize Their KYC Processes and Stay Compliant

KYC refers to identity verification procedures used to ensure customers are who they say they are. KYC is also a part of AML regulations framework that is an umbrella term for the entire set of mechanisms deployed to protect against money laundering and financial crime. There are four different components that are used in this process for any company:

- Customer Acceptance Policies;

- Customer Identification Procedures;

- Monitoring Transactions;

- Risk Management.

Those who are looking to not only prevent insurance fraud but also streamline the customer onboarding process can look to provide better steps to the KYC processes that they should use within their company.

In the past, the KYC method was an error-prone, lengthy, and time-consuming process. On top of that, it wasn’t scalable at all, which is why it is important to look for an automated approach or solution.

Modern Identity Verification solutions enable companies to achieve fast and accurate results, provide a great onboarding experience to their customers, which results in better conversion rates and prevents fraud from happening. Identity verification software technology stack utilizes a multi-layered approach to provide the highest level of security and protection. Automated and complex software doesn’t let “bad actors” through the gate.

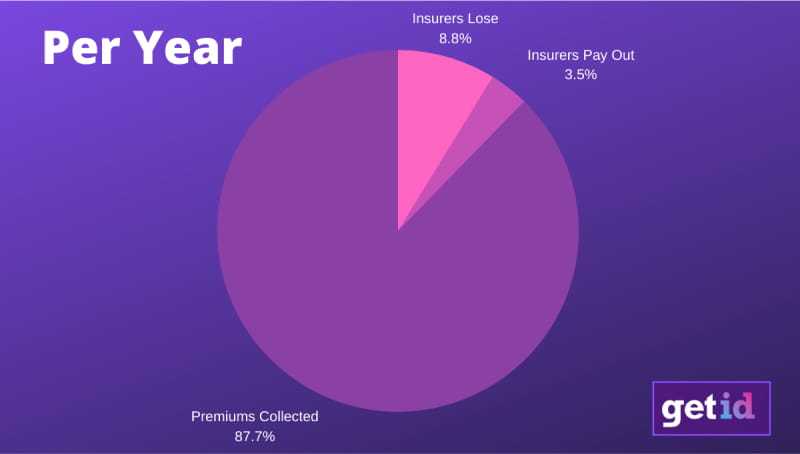

What are the Consequences of Fraud?

Committing fraud, whether as a client or broker, comes with severe consequences. If a client signs up for coverage through your firm, and they commit fraud through the system, this can come back on your company, brokerage or firm due to the illegal activities happening. Some of the things that can happen include, but are not limited to:

- Having a smaller revenue;

- Bad user experience due to manual client checking;

- Poor client onboarding;

- The inability to stay compliant with regulations, which leads to penalties because these regulations continue to become more stringent and need to be kept up on.

Identity Verification Solutions for Insurance Firms

There are a number of simple solutions for insurance firms to consider when they are looking at the many ways they can make their lives easier, while still being compliant to the regulations that need to be followed.

Onboarding & Authentication

- Identity Verification – Verifying the identity of those who are signing up means seeing not only photo ID but also other forms of verifiable income.

- Document verification – is a process of verifying the authenticity and validity of a document. Officially issued documents, such as ID, driving licence, bank statements or other state issued documents are usually being verified. The process checks the validity of personal data, including: name, age, address, as well as document features like: stamps, watermarks, fonts, carrier materials and others. Modern solutions, like GetID, enable companies to verify customers’ documents automatically without having clients to be present.

- Face Matching technology is biometric facial recognition for identity verification. Far more accurate than a human, Face Match technology identifies human faces. It does this by comparing the applicant’s image to other images in official databases. By matching an applicant’s face to a previous official photograph, the technology verifies an applicant’s identity.

- Liveness Check – Liveness checks are a crucial step in effective ID verification. Just like the use of forged official documents, face-spoofing is used to fool verifiers. In these scams, fraudsters use photos of other people. Liveness checks solve this problem by having the applicants verify themselves live on camera. Applicants verify their validity by first showing their face, often next to the official ID, like a passport. Next applicants are asked to complete previously undetermined actions, such as blinking, turning their head, or holding a handwritten note. In doing this, they prove the video is live and hasn’t been falsified in preparation. In this sense, liveness checks speed up verification as they can happen in the moment and within seconds.

Advanced Solutions for Insurance Firms

Advanced solutions for insurance firms are more rigorous and require more attention to detail. They are not as simple as having to check the identity or verify the information of those around them. This is something that a lot of insurance companies do not understand. Digging deeper into the bigger crimes and fraud is essential for any insurance firm.

High-risk customers are those that have a background of poor activities. This can harm the insurance company if they are not careful. Having the proper monitoring solutions is essential for protection of the insurance company.

Prevent Money Laundering

- CDD and EDD solutions

- Sanction Lists Screening

- Ongoing Monitoring of Clients

In addition to the above-mentioned steps, those insurance companies are also able to optimize the process by following these three steps:

- The Customer Identification Program.

This program is also known as CIP. This program is designed to protect the identities of those who are signing up for insurance. Those brokers within the companies have to verify their identity before they can have an account with the program. - Ongoing Monitoring.

Being able to monitor your clients is essential. You might check in just once after they sign up, but that has been shown to not be as effective as checking up regularly. Those who are more at “high-risk” are monitored and this protects the company from any sort of fraud. This protects the company because you can see what is happening on each account with every change being made. Ongoing monitoring can not only ensure that you lower your risk of fraud as an insurance company, but also hold onto well-intentioned, long-term clients. - Customer Due Diligence.

It is important that the insurance company, broker or firm is able to trust the client when they sign up for an insurance plan. Customer due diligence is needed in order to create this bond between the customer and the firm who is holding their insurance claim. Clarifying risk categories, speaking with the client and making sure they understand their needs are important factors to keep in mind.

While you have to do your due diligence, it is important that you understand the risk classification but also that you know that there is some amount of risk that comes with any process you’re going through. The company that you run needs to protect itself. Not only can your company get into trouble by not being compliant, but you can lose a lot of money and have to pay fines.

It is important that you consider all that needs to be done in the case of something like this. Not only do you need to protect your firm, but those clients who are using it. When fraud happens, it can devastate those around you, not just your firm. Following the guidelines and regulations set forth for all businesses, insurance or not, regarding fraud can help you protect yourself, your business, and those clients who are working with you every step of the way.

Since there are many ways to verify those who you are working with and safeguards you can put into motion for your company, it is important that you use them or find a company who can do the checking and other specifics for you. This is the only way you can truly prepare yourself against fraud or other issues that might come about within the insurance firm.

The Solutions That Can Help

There are a number of solutions that those faced with the regulations and a number of other issues can use. It is important to look towards the easiest, but most effective way to help your firm continue to operate.

GetID services have and can provide the best and most comprehensive KYC and identity verification for insurance firms looking to streamline the KYC process, but also protect themselves and their clients.

Advantages of Using GetID

- Be able to approve more legitimate customers to drive revenue

- A quick and easy identity verification and authentication process to deter account takeover or identity fraud

- Have access to cross-industry consortium fraud data and alerts

- Use an on-demand platform that has plug-and-play configurability

Since there are so many modern-day fraud types, it is important to keep up to date with the modern-day solutions that can help protect your company. With apps and other companies that are there to provide that behind-the-scenes protection that you need, not only can you allow them to take the work out of having to do this yourself, but it can increase the productivity of those brokers looking to gain more accounts.

As technology continues to grow, those firms that need more clients and having to take on clients slower than normal can put a wedge in the way you do business. By having an automated omnichannel solution that does this for you, you can feel more confident being able to do so quickly, efficiently, and more effectively.

Insurance companies are able to protect themselves through a number of means. They can do the footwork themselves and ensure that they check out each and every client that wants to sign up for an insurance account, or they can hire a company to do this. This is a slow and expensive approach for an AML insurance company to check each customer. They can put warnings, labels, and other disclaimers on their documents, but this, in turn, takes not only more time but it doesn’t guarantee that those clients will read or follow the rules.

Automated solutions are fast, accurate, cost-efficient, and scalable. This provides the company with a way to quickly get the answers and protection they need to reduce the amount of money lost from fraudulent activity.

While many professionals have been through classes that show them how to detect and prevent fraud, this is not something that they focus on a lot or enough. This is why many companies need to reach out to companies that specialize in this type of fraud prevention.

Streamlining the onboarding process for these clients is one of the best things that any insurance firm is able to do for their clients. This process allows them to go through the motions from home, but also ensure that their identities are verified, and that protection is happening in the background. This streamlines the process, while ensuring that the brokers can focus more on bringing new good-willed clients in.

Take the time to learn more about these programs and how they may be able to provide you with the help you need and want as an insurance firm looking to safeguard yourself, your company and your clients. GetID has the simple and more advanced solutions that provide you with a way to safeguard yourself and ensure you are obtaining the quality measures needed to really prevent fraud from happening, regardless of what type of fraud.

If you are considering streamlining your process, taking some of the work off your own shoulders, and allowing your brokers to search for more work and be more productive than ever, then GetID is the solution you need.

With the advancing world of technology around you, it is important to seek out the best possible solution for those who are looking to secure their placement within the insurance world. GetID understands this, and they have professionals who can walk you through the process of using their system and answer any and all questions you may have. It is important to seek out the best and right help for something like this, as not keeping up with regulations can cost you the business you run. Sign up for help today and reduce the chances of fraud tomorrow.

GetID provides you with an automated way to protect your insurance company from fraud. Saving you time, money, and offering a scalable protection method, the program works for you. Reach out to GetID team to find out more.